Strategy Cruncher user Mugu sent me this question (shared with permission). This is a great question that gets to the heart of how to improve strategies.

To give you some background, Mugu submitted his backtest from Amibroker with column data he added using the sample code provided by me in the forthcoming Amibroker course.

The Cruncher parsed through his backtest and is suggesting optimal ways to improve his strategy. He’s trying to choose between two ways to make his strategy more efficient. That is, fewer trades but higher profit per trade.

Mugu:

In which order should I implement the suggested column filter improvements on a report like this.

- Should I prioritize curve improvement or total profit improvement on the Cruncher output?

- The second suggestion in the report results in a good improvement in profit factor + Sharpe ratio and half the exposure of unfiltered strategy run. It seems to me the second suggestion should have been ranked as number one on the report from the cruncher?

Dave:

The ranking in the cruncher report is ordered by the optimal way to split the trade set where the difference between the average profit of the green set and the red set is largest.

(It’s hard to explain, but the sample report gives a good visualization of the ranking. Scroll through the charts here.)

And it’s doing that across all columns – no matter how many you’ve included.

(A Trade-Ideas backtest has over 200 columns and I have Amibroker backtests with over 300 columns.)

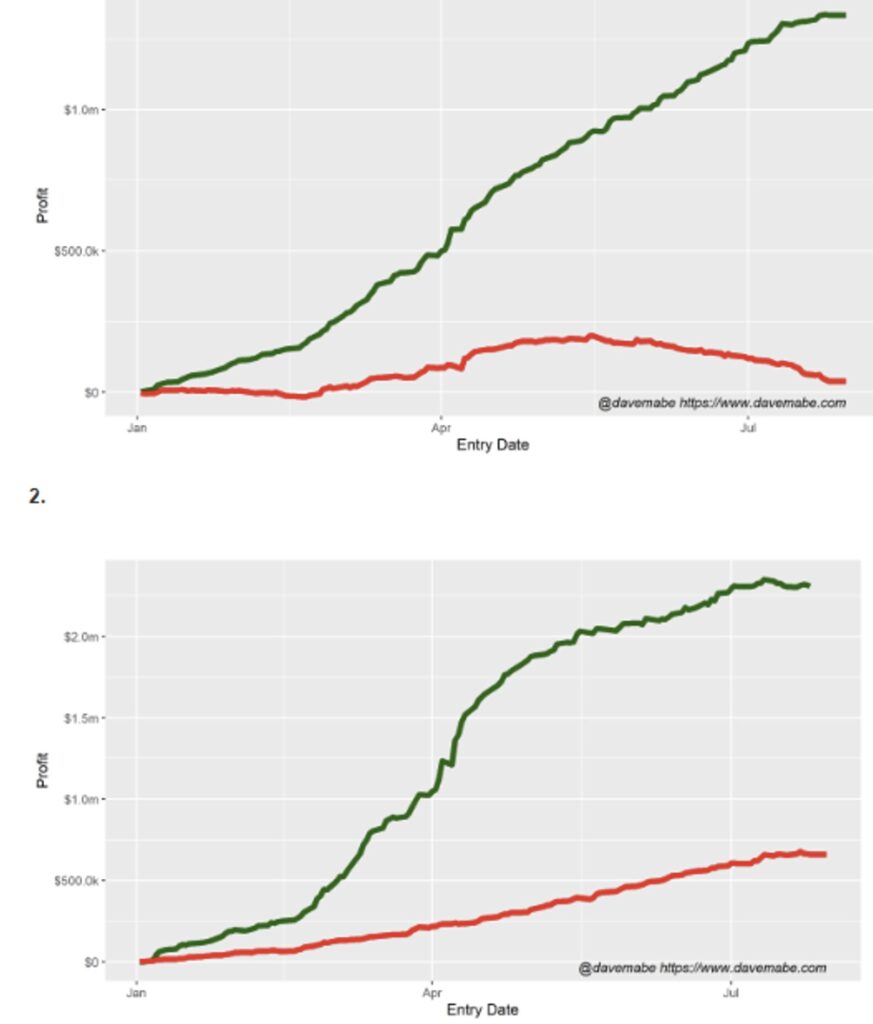

In the charts from Mugu’s cruncher report, notice the smoothness of the green line in the first one compared to the second one.

I consider that more consistent and therefore more likely (although not guaranteed) to continue into the future.

Also look at the second chart. In that one, the red line is smoother than the green one. In fact, the recent period shows performance that’s roughly equal across both the green and red lines, and the red line is profitable overall.

For these reasons, all things equal, I’d prefer the first suggestion from the cruncher.

Thanks for sharing, Mugu.

-Dave