The first strategy I traded was a gap strategy and a continuation play.

Gap up? Look to get long. Gap down? Look to get short.

It was straightforward: easy to follow and manually trade when I had limited time to dedicate to trading.

Luckily, it worked and I was well on my way.

So why did I want to change things? If it ain’t broke, don’t fix it, right?

As I mentioned last week, I had a strong sense that some of the rules were arbitrary.

I didn’t think they were wrong, but I thought a data-driven approach would point me to better values.

To get started, I took one of my recent gap trades and wrote code to backtest the strategy for that single symbol.

This is a great way to start since backtesting the entire market from the beginning is more difficult and time-consuming.

That recent trade was fresh in my mind – it wasn’t theoretical since I had just traded it live.

Once I got the backtest working so it would match my single recent trade, then I ran it across the entire market.

I made some adjustments, but finally got it closely mimicking what I was doing with my manual strategy.

That was great but the next step was a game-changer.

As I traded my original strategy, I would often see gapping stocks that almost met my trading rules but didn’t.

I wouldn’t budge on my rules – so I would let these go without trading them.

But I noticed there were a lot of these that I was intentionally skipping.

Statistically, there had to be many of those that were worth trading.

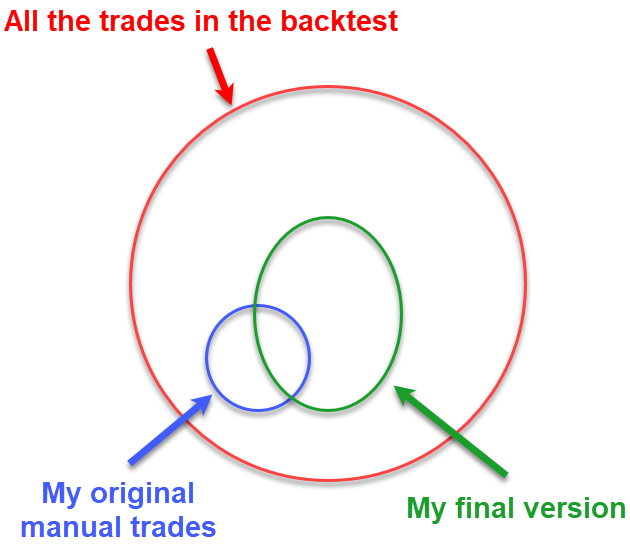

I decided to place parameters in my backtest to loosen my tight rules – so much so that many more trades ended up in the backtest. Probably 3-4 times the original number of trades.

My plan wasn’t to trade all of them but to use the data set to find better rules to filter for the most profitable trades.

I didn’t realize it at the time, but this planted the seeds for my systematic process of finding and improving trading strategies.

What this allowed me to do was find a much larger subset of trades where the average profit per trade was HIGHER than my original manual system.

There was some overlap but not as much as I was expecting.

To visualize it, look at this Venn diagram.

More trades each day with a larger profit per trade on average.

That’s a huge improvement but the real breakthrough here was the beginning of my workflow for creating profitable trading strategies.