List member Brandon C. replied in response to my recent post on position sizing with a good question (name used with permission).

Brandon C.:

What are your thoughts on dynamic sizing based on risk? For example, you have set parameters for grading an opportunity/catalyst and risk tiers and acting accordingly.

- Grade A and A+: 80 to 100% of your daily stop

- Grade B setups: 40%

- Grade C setups: 20% and so on.

Dave:

I love this approach.

It’s definitely not for beginning traders, but it’s something all traders should be shooting for and thinking about.

Why?

It puts you in a mindset to scale your strategy.

Take a look at your equity curve for your backtest.

Now imagine, before entering, being able to identify the most profitable 20% of the trades (without curve fitting).

When you can do that, you have a powerful way to scale up your strategy by increasing your size in the most profitable trades.

Some traders tell me that there’s no way they can do this with their strategy – every trade has the same probability of succeeding.

But there’s just no way that can be true.

Once you develop a strategy that works, this is the next step for making it significantly better.

Thanks for the question, Brandon C.

-Dave

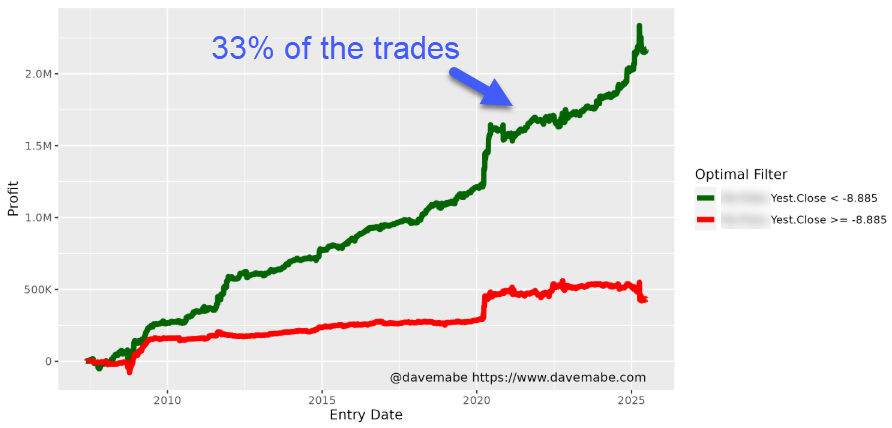

P.S. The Strategy Cruncher is the perfect tool for figuring out how to increase size in the most profitable trades in your backtest. Here’s an example from one of my strategies that I backtest in Amibroker. This comes right from the cruncher report. I can quickly see from this one suggestion from the cruncher that I can use a larger size for this set of trades. This rule is based on the distance from yesterday’s close price – something I would not have been aware of if the cruncher hadn’t suggested it.