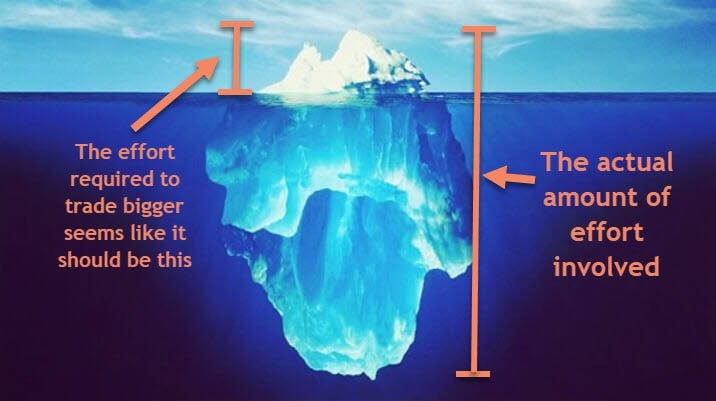

Going from an initial trading strategy concept to actually trading it with meaningful size is a long and perilous journey. Having traded for over a decade now, I’ve gone through this process multiple times for dozens of strategies. If you’ve traded for any length of time you realize that, like many aspects of trading, this is far bigger topic and more difficult than it seems on the surface. It’s easy to fall into the trap of barreling down this path instead of carefully tiptoeing. I’ve made a bunch of mistakes in this area over the years (and some I still repeat!) — I’ll go over them here in hopes that you can know the pitfalls ahead of time and not repeat them.

The Most Important Thing to Remember About Scaling Up

If you only take away one thing from this post, let it be this. If you feel pressure for any reason to scale up quickly, you will end up making costly mistakes and you’re going to do it wrong.

Some traders come across a strategy that they feel has a limited shelf life and they need to scale it up quickly before the edge evaporates. If you believe this to be true then I would argue it’s not a strategy worth trading at all. Here’s why: when this strategy has a drawdown it will be impossible to determine whether it’s “normal” or the edge has evaporated.

This is why I always try to cook up strategies with the longest shelf life possible and I think about this from the very beginning of the trade concept stage. A strategy’s edge will fade over time but ones with strong staying power can be tweaked many times to improve their edge. After trading with size in a strategy for a length of time, you may have improved the strategy through what you’ve learned to the point where the strategy is significantly different than the initial concept.

My Stages of Strategy Cultivation

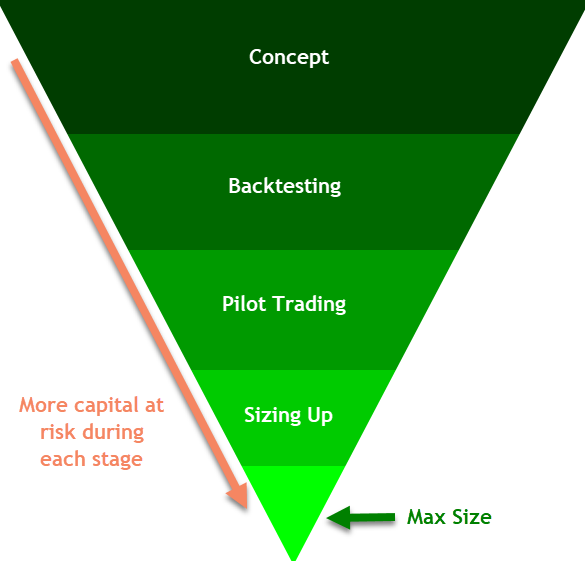

Each strategy goes through several stages of development. Only a few end up making it to the last stage but of course that is the goal.

Stage 1: Concept

This is the very first stage where you have an idea for an edge.

Stage 2: Backtesting

This is such an important step since it involves getting a trade idea from concept to an actual system that can be theoretically traded. You’ll discover a lot about how your system works during this phase without yet risking any money.

Stage 3: Pilot Trading

Especially for new strategies or inexperienced traders, these trades should be paper trades. Over time as I’ve gained more experience I generally spend less time paper trading and instead take what I call “pilot trades” — real trades with very, very small size. No matter what size you think is “small,” go smaller. The point here is not making money, but making your system prove itself to you.

This is the phase where I’m often too optimistic about the trading strategy. You need to be very skeptical at this point. This is the first point where money is on the line and there is probably the most to learn of all the phases. You’ll find out quickly if the system has flaws. Be sure and discover them using as little money as possible.

Many systems won’t make it past the Pilot Trading phase. In some cases you’ll need to make significant adjustments and go back to the Backtesting phase. In others you’ll need to abandon the idea entirely for one reason or another.

Stage 4: Sizing Up

Hopefully some of your strategies make it to this phase. They’ll need to have proven themselves to your skeptical self (the more skeptical you are the better). It’s very tempting at this point to let a strategy loose and put on too much size too soon. This is a mistake I, unfortunately, still make occasionally.

The problem is there are a lot of different types of markets and your system may be more or less robust in some of them. There is also a very real psychological danger here: as you increase size your equity curve could quickly turn negative as new losing trades with larger size overwhelm previous winners that were traded smaller. The system could be acting in a completely “profitable” way but you’re staring at a negative P&L overall. If you size up too quickly it increases the odds that this situation will occur.

This is one of the main strengths of using R Multiples and Expectancy to measure strategy performance — it is consistent regardless of your current position size. So unlike many metrics like Profit Factor, however you’ve varied your position over time you’ll get a consistent measure of performance — very valuable.

Most strategies spend a very long time in this phase. Remember what I mentioned earlier — there should be no sense of urgency to hurry things along. I have a strategy that has been in this phase for 5 years, slowly increasing size!

Stage 5: Max Size

We all want strategies to get to this point and your maximum trading size is likely changing over time. Even when you have a lot of confidence in a system it’s still psychologically difficult to increase size beyond certain points. Of course larger profits are always great, but achieving them will absolutely require tolerating larger drawdowns.

Important Takeaways

If you forget everything about this post, remember these things:

- Be very skeptical — more skeptical than you think you need to be. Make your strategies prove themselves to you over a long period of time.

- Don’t be in a hurry, especially when money is on the line.

- Use a metric like R Multiples that allow you to measure performance regardless of your position size.

- Get ready for drawdowns because they’ll come.

2 comments

Comments are closed.