Fellow list member Robin J responded to my message from a couple of days ago with a success story about applying lessons from the Get Systematic Roadmap (she was an early beta tester for it) on expectancy (shared with permission, with minor formatting changes):

Robin J:

I met with you when you were starting your individual sessions. I’m the teacher who quit teaching to trade.

When I started trading, it was like printing money. Then came the breakeven period. Thankfully, even with drawdowns, I’ve never ended up at a loss.

I just thought, reflected, let it percolate.

Then came the epiphanal moment on how to finally get my risk management under control, consistently. I had been feeling like the more I strived for the generating consistent income approach, the more I missed.

It took about a year to really nail it down. (You and I worked on R primarily in my session with you.)

I thought I’d share that one of the things that has helped me tighten this up was actually using the expectancy equation.

Expectancy = (Pw × Aw) − (Pl × Al)Where:

Pw = probability of a winning tradeAw = average win sizePl = probability of a losing tradeAl = average loss size

From there, I could think about how to cast a wider net in a way that allows me to continue to scale. I also decided that it would have to scale itself, like a biz building itself. I wanted to prove the concept, so I started in my paper account and then took it live once it had accumulated enough evidence for me.

Essentially, I shifted from trying to catch a medium or large fish each trade to how can I catch lots of smaller fish in one net on a regular basis, and tip the balance in my favor in a way that I can then end with a bigger haul than I would have.

Our talk about R made me realize:

- that I didn’t know what that was!

- that I needed to adjust my expectations.

- that I was going to have to put in some work and calculations to identify exactly how to make my strategy work. When we run so much based on statistics, but when you are 1 person with 1 account, that changes how the statistics are going to work in reality.

- And the mantra “live to trade another day” needed to be integral to my practice.

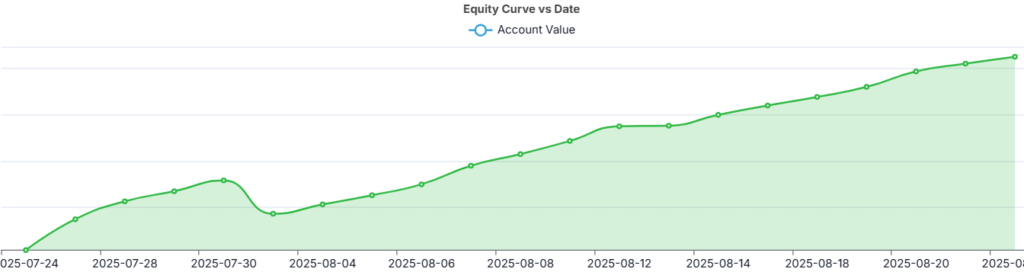

And this is my equity curve with my newly applied risk management, starting late July:

Congrats to Robin on her breakthrough!

I hope this inspires other traders to leverage good risk management and apply it to their own strategies.

-Dave