Imagine you’re playing poker and one of two scenarios plays out.

Scenario A: you’re dealt a pair of Aces and the flop comes out Ace, Ace, King. You’ve got four-of-a-kind.

Scenario B: you’re dealt a pair of sevens and the flop comes out Jack, six, three. You’ve got a pair of 7s.

Would it make sense to allocate the same amount of money in each scenario? Of course not – in scenario A you have a much stronger probability of winning the hand.

Yet this is what I see most traders doing with their trading strategies: they use the same position size for all of the trades in their system. It’s a reasonable approach for getting started: as you gain confidence in the system, you can easily size up by increasing the amount of risk you’re taking per trade.

But this assumes that every trade in your system has the same trading edge. Of course, that can’t possibly be true: there’s a huge variability in the likelihood that your trades end up being profitable and to what degree. Using the same size for all your trades is like betting the same amount with your four-of-a-kind versus your pair of sevens in the poker example. You’re missing out on a lot of profit doing it that way.

You can simply increase size across all your trades, but ultimately, the best way to improve your trading strategy is to identify the subset of trades with the highest trading edge and trade those with more shares than your normal position size. Find your four-of-a-kind scenarios in your trading system and use that to your advantage.

When you use an increased size you will have some larger losses, but if you are able to identify the right subset of trades, the outsized gains from the profitable trades will easily overwhelm the losses. After all, a four-of-a-kind in poker sometimes loses the hand, but that doesn’t mean it’s not an overwhelmingly profitable situation!

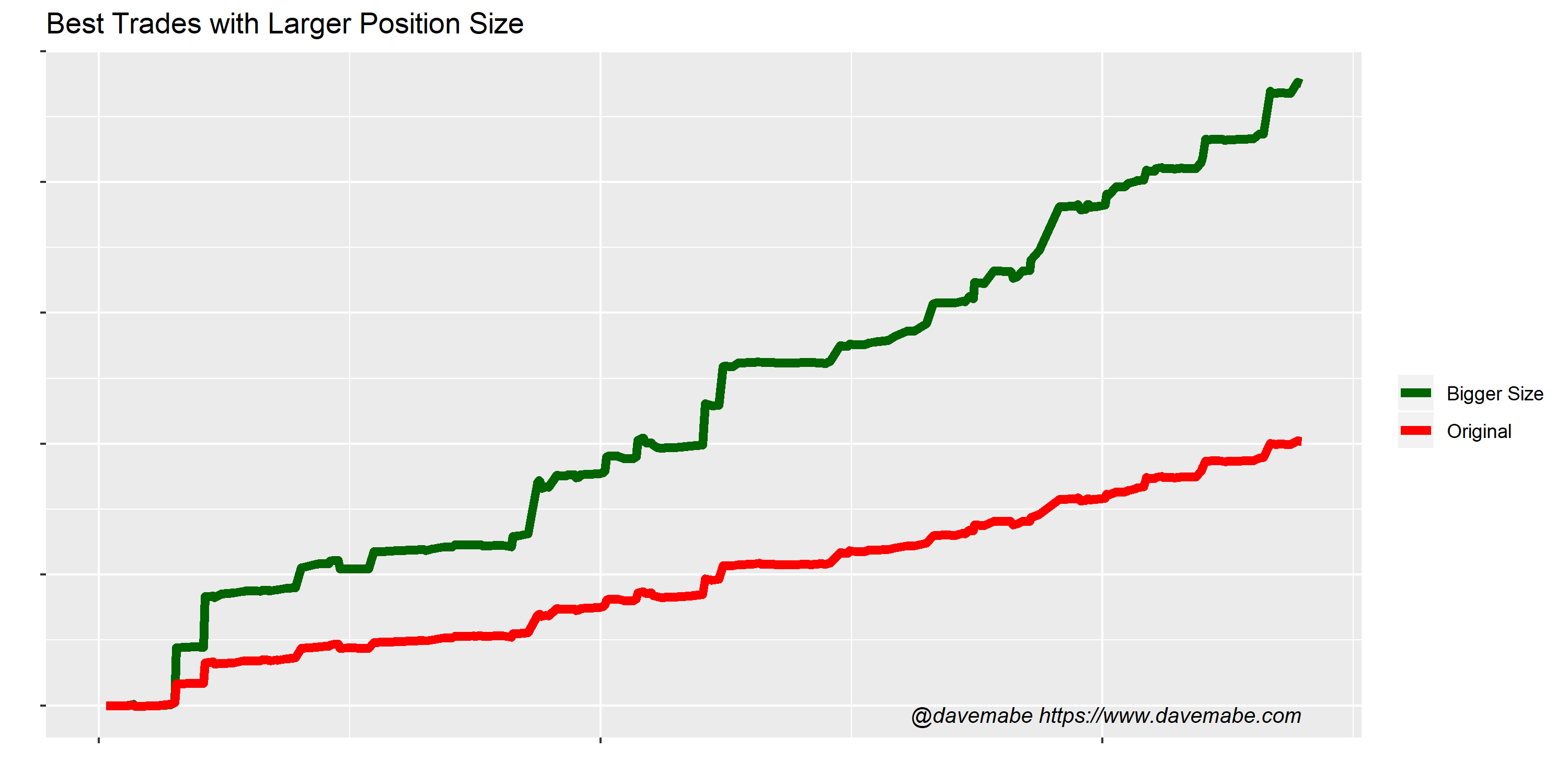

Here’s an example of going through this exercise with a trader that’s working with me to improve his strategy. We were able to identify a solid subset of trades in his system that were contributing most of the profits and reasonably trade them with larger size. Here’s the equity curve of the original system with consistent sizing for all trades (the red line) compared with the same system but taking trades with the strongest edge with bigger size (the green line).

The benefits go well beyond just the increased profits. Soon you might be able to shed some of the weaker trades in the system and free up buying power for additional strategies.