Mike Bellafiore from SMB Capital wrote a tweet a few days that sparked a lot of replies from the trading community:

If you place a trade with a defined stop, your stop is triggered, and then your original thesis pans out, what say you about your original trade?

The responses ended up being a great discussion on what to do when you get stopped out of a trade, only to see it continue on in the direction of your original trade. Here’s the video of Mike summarizing the discussion and including his take on the responses.

Here’s my take on this frustrating situation which Mike references in the video.

Here I think is the best response to Mike’s original tweet that I think echos what I said in my post:

@MikeBellafiore Shit happens, move on. Now if this is the umpteenth time it's happened, might want to check your pre entry criteria before just increasing your stop loss.

Any single trade is unimportant! In fact, even with a well defined strategy to re-enter trades like this, you are still guaranteed that these frustrating situations will occur.

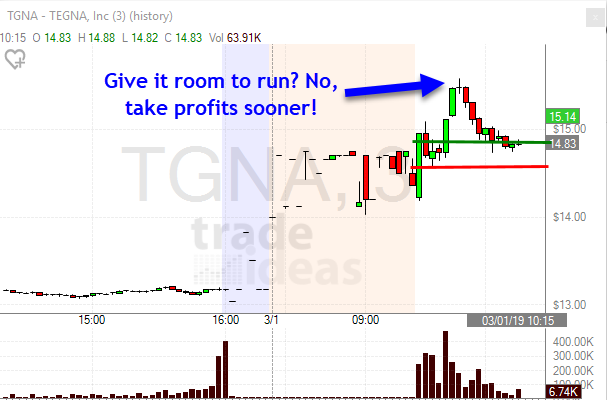

To assume that there’s something to learn from every single trade you make is both overly optimistic and pessimistic at the same time. Why? It is absolutely essential that you learn to take losses well. Trying to find fault with every losing trade is foolish since the takeaways from different trades will often conflict with each other. For example, “take profits sooner” versus “give your trades room to run.” Here are two charts with potentially conflicting lessons.

If you’ve done your homework, these seemingly conflicting lessons are irrelevant — you’ll know what works across a large number of trades and you’ll be trading accordingly.

Getting caught up in trying to identify what you did wrong in each losing trade is a sign that you have an irrational need to be right. Do you want to be right or do you want to make money? If this is something you have a problem with then you might want to shift to another strategy with a higher win rate (although that usually comes with a tradeoff of a lower average profit).

If you get caught up in the results of a single trade, then it’s probably a sign that you need to do more preparation away from the trading desk. If you’re fully prepared, you can trade confidently knowing getting stopped out of trades that would have ended up profitable is pretty common.