Nicola Olyslagers is an Australian high jumper who won a silver medal in the Tokyo Olympic Games in 2021.

But unlike every high jumper or even any world-class athlete I know of, she has a very peculiar habit.

It’s a habit that’s extremely visible and obvious with every attempt she makes to clear the high jump bar in a competition.

After each jump, every other high jumper might wave to the crowd, take a drink, get in the shade, and prepare for the next attempt.

But not Nicola.

After every attempt, she immediately goes right to her bag, pulls out a green book, and spends several moments writing something in it.

When she misses a height she immediately writes in her green book.

When she clears a height she immediately writes in her green book.

Even when she cleared the height that guaranteed her the silver medal in the Olympics, she immediately, and through tears of joy, wrote in her green book.

As you can imagine, as she rose in the ranks, this habit went viral because EVERYONE was so curious about what she could possibly be writing in her book after every single jump at the sport’s biggest stage.

So what DOES she write in her book?

The high jump is an incredibly technical event – there are multiple phases to every attempt that have to be orchestrated precisely to maximize your chances of clearing the bar.

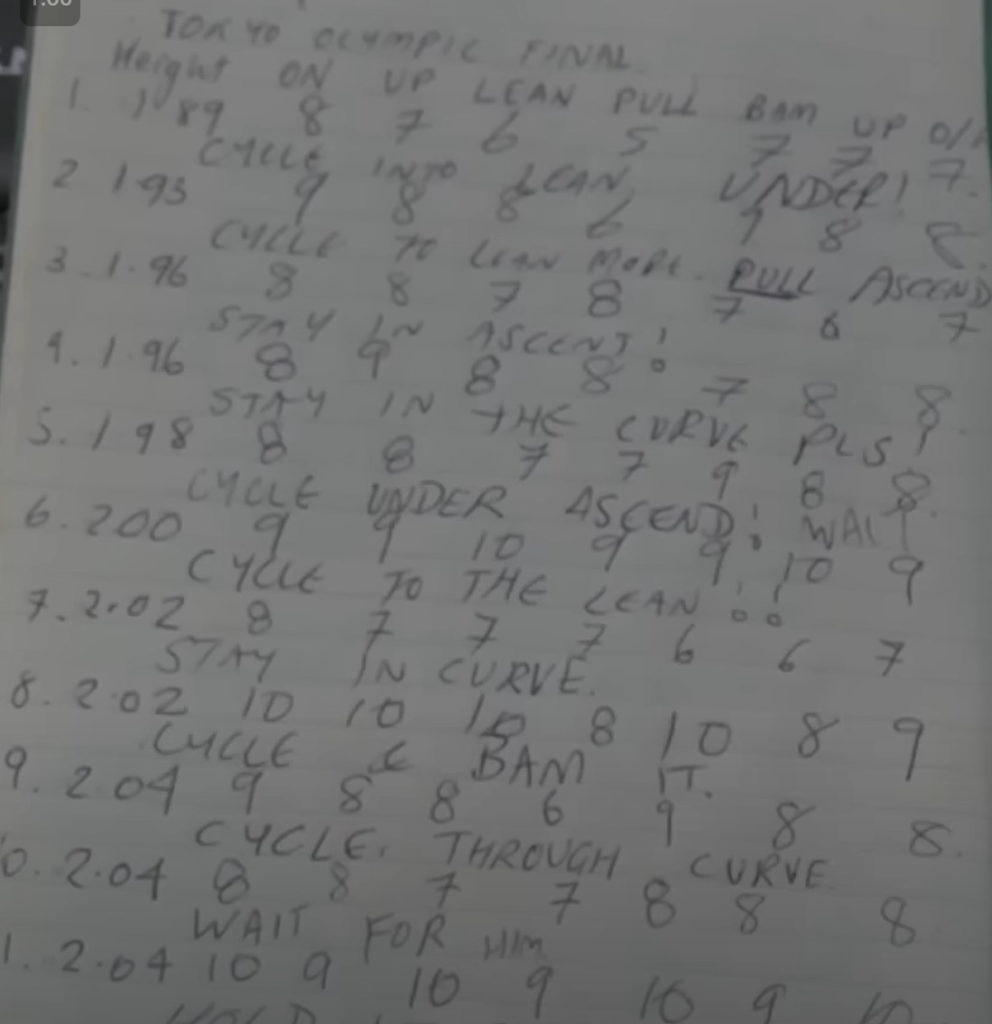

Nicola has created a structured process for herself where she grades her performance from 1-10 on every one of the 7 phases of the attempt.

Here’s a screenshot of her journal from the Tokyo Olympics when she won silver:

Some Takeaways

There are several key aspects to her process that traders can learn from.

- It’s simple, structured, and repeatable

- Each entry is short – there’s not enough time to write a novel between jumps, so while she could likely write more, she’s distilled it down to what’s important and nothing more

- Whether she clears the height or not, it’s the same format

- There’s not even a check mark for whether she cleared the height or not!

- She writes one (just one!) simple message for herself to focus on for the next attempt

As a trader, you should be grading yourself on whether your trade was well-executed and according to plan – the profit of the trade is secondary.

Bottom line: Be more process-oriented rather than results-oriented.

When you focus on refining your trading process, the results will come.