Every once in a while you’ll hear someone make a seductive claim. It goes something like this:

As long as you have good risk management and size your positions properly you can make money with even random trading entries.

Once you start looking you see various forms of this concept everywhere – it’s even mentioned at least once in the well known Market Wizard books by Jack Schwager. For the first part of my trading career I believed this. In fact, I made this argument to several people over the years.

After more experience and trading multiple strategies, I no longer believe this to be the case. First some background.

The First Trading Lesson I Learned

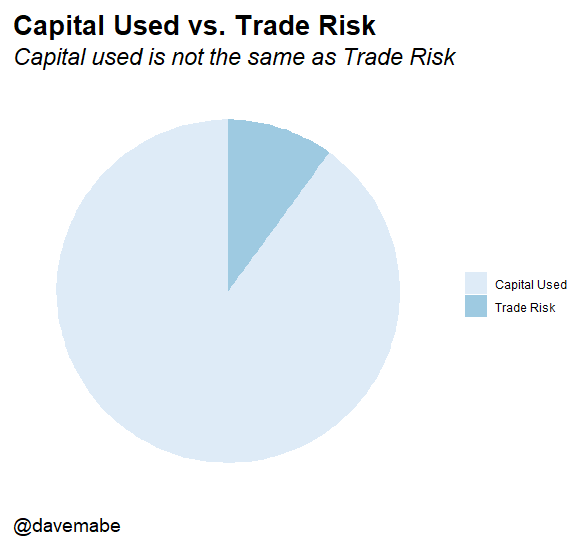

My first trading light bulb moment was about risk. When you make a trade you have a certain amount of capital at work, but what I realized was that entire amount wasn’t really at risk. Of course, yes, technically it is “at risk”, but as you are probably aware if you’re reading this, that’s not the best way to think about risk when trading.

What you really have “at risk” during your trade is your maximum loss you’re willing to take on the trade, not the total amount of capital at play during your trade.

Luckily I internalized this concept before I took my first trade. It’s a fundamental building block of every strategy I trade.

My First Trading Strategy

I think a lot about the first strategy I ever traded. I studied very closely Maoxian‘s dummy trading lessons. There was a lot of valuable information in those trade reviews. (It’s no longer on his site but he tells me that he has located an archive that he will be restoring when he gets to it.)

I went to Atlanta to visit my sister-in-law and while I was there I contacted Trader Mike, a well known trading blogger at the time who lives in Atlanta, to see if I could look over his shoulder while he traded one day. He agreed and I watched him trade the open and then we went to lunch and I soaked up every minute with him. He was very open and helpful and encouraging. The one idea that stuck out at me was risk management and proper position sizing.

I went back home and within a few days I started making some trades using this strategy. While I wasn’t wildly successful right away, I was mostly profitable those first few months.

I have made major modifications to that core strategy over the years, but it’s essentially the same theory and I’ve traded it continuously for almost 15 years now.

At the time I assumed that risk management was the key to that early success. It was just a matter of time before I could apply proper position sizing to another strategy and it would be successful too.

I Was Just Lucky

I started branching out into additional trading strategies. How hard is it to come up with a random trading idea? Not hard – just come up with any idea and apply proper position sizing to it and it should work – so the theory goes.

After taking this approach with a variety of strategies, I began to realize slowly over time (too slowly!) that proper position sizing wasn’t a strategy in itself that could cure any trading idea no matter how bad it is.

I realized that I didn’t have some sort of natural, innate ability to be a trader: I was just naively lucky when I started! That first strategy I traded just happened to be one with a solid theory that was pretty stable over time and I just happened to have come across it. What would have happened if the strategy I first traded was, like most strategies, pretty mediocre? To be honest I have no idea what I would be doing now.

It’s the Strategy

This point might be obvious to most traders and indeed it does feel weird to even type it: the strategy you trade is really, really important. That first strategy I traded was way better than I thought it was at the time.

The idea that you can take ANY RANDOM entry and simply apply good money management and position sizing and have it be profitable is one of the most common trading myths I see.

Good position sizing is extremely important but it’s not going to save a crappy strategy. It is certainly a fundamental requirement for good trading but it is not the strategy itself!