In the April 2020 issue of Technical Analysis of Stocks and Commodities magazine, Ken Calhoun outlines his Closing Range Breakout trading system. Ken is on Twitter and tweeted this interestingly prescient market call on January 24:

Not bad actually.

In this post I’ll outline the Closing Range Breakout strategy, provide some commentary, and offer some thoughts on how I would modify it if I was forced to trade it.

The System Details

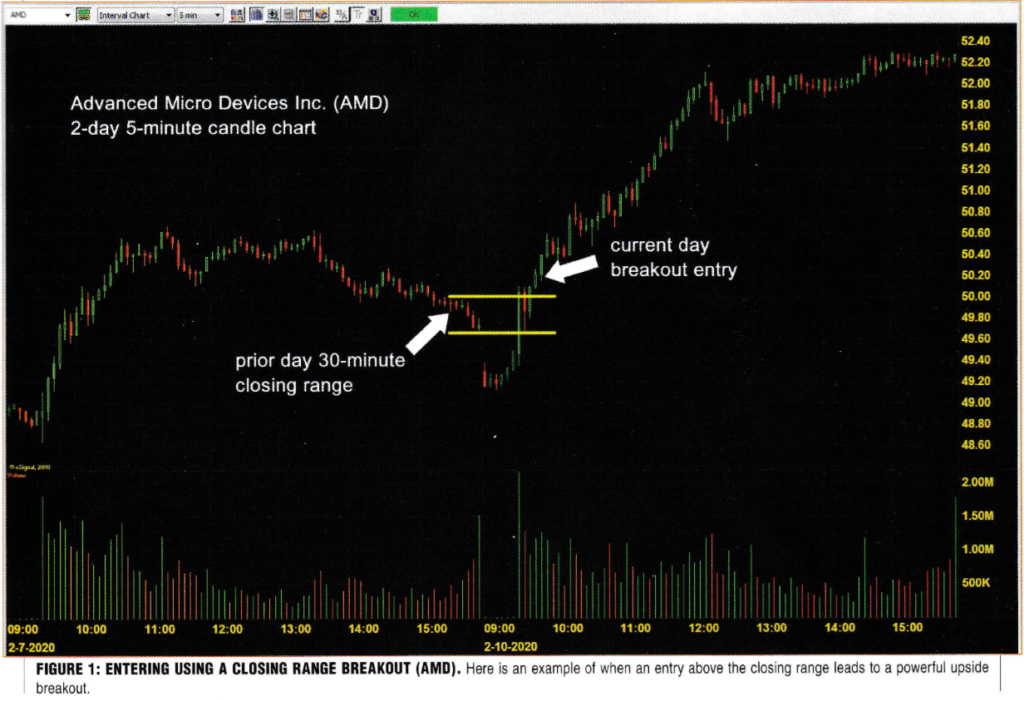

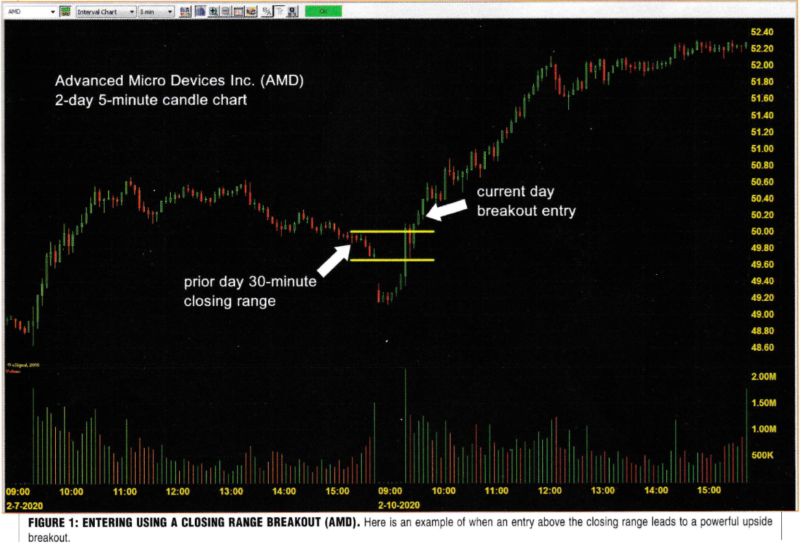

This intraday system is based on two days of trading – it’s a combination of the range of the last 30 minutes of trading yesterday, plus a modest gap down today below that range. If that occurs, then you’re looking for a breakout above the top of the range from the last 30 minutes yesterday and you’re placing a stop at the low of that range. Here’s a chart that is included in the article that makes it easy to see.

For this example, the closing range yesterday (2/7/2020) for AMD was $49.65 – $49.98. The next day (2/10/2020) it gapped down slightly opening at $49.47. It quickly went above the high of yesterday’s closing range ($49.98) so here is where you’d go long. You’d put a stop underneath the low of the closing range at $49.64 or so.

There’s no mention of a target or a hold time in the article, but it seems reasonable to assume you’d be holding until at least the close.

Ken mentions that high-frequency algorithms typically use daily open/high/low/close values so this technique allows you to gain some “price improvement” by getting in before it hits the daily high. He also mentions that he often uses an additional strategy to scale into this trade later. (If you know me you know how skeptical I am when people mention how gracefully they scale into trades.)

Is This Strategy Worth Pursuing?

Most of the strategies I read about I’m highly suspicious of. I actually think this one might be worth further study. There are a lot of details missing (hold time?) and he does include some apparent rules with no detailed explanation. For example, he actually uses $50.20 for the entry above and provides the arbitrary explanation that “$50.00 + $0.20 = $50.20”. He also mentions that it is “best” if it takes less than 15 minutes for the range breakout to occur, but no mention of what he considers “too late” to take the trade.

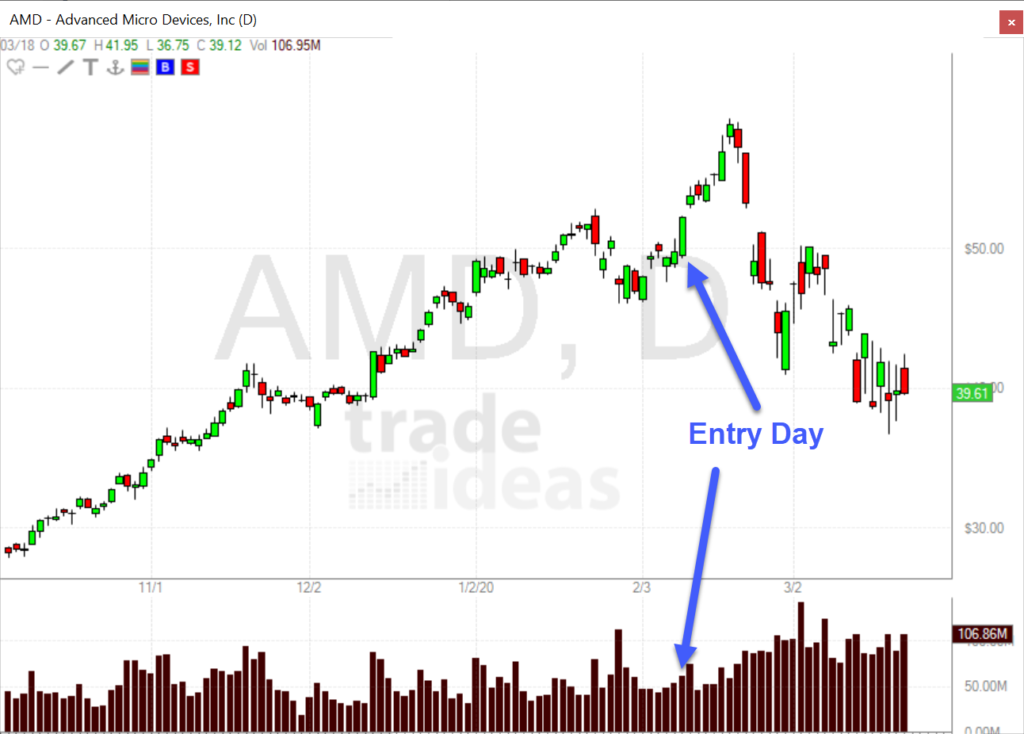

Ken also mentions that this is a relative strength play, but the volume on the entry day is not particular strong compared to the previous day. Here’s a daily chart of AMD with arrows pointing to the entry day.

Although a perfect description isn’t included, there are enough details to warrant researching this idea further.

Next Steps for this Strategy

It’s important to know your trading style and what is in the realm of possibility for you to trade. The very first question I ask myself is how many trades per day does the system generate. Without doing any backtesting my guess is that this system likely generates a lot of trades since the rules that were outlined are fairly loose, especially given the apparent lack of minimum volume requirements.

I’m looking for trading systems that, prior to any filtering, produce a lot of trades. There are a variety of reasons for this, but it boils down to the fact that with many trades to start off with, I know I’ll be able to selectively filter the trades down to the most profitable ones and still have it trade frequently.

The good news is that this strategy should be pretty easy to generate a backtest for. The rules are clear enough and not very complicated.

After generating the backtest I’d want to look at two different things right away:

The Height of the Closing Range

Because the closing range constitutes the entire setup of the trade, it will likely have a dramatic effect on the system. Also, we’re not talking about the opening range which is typically wide – sometimes these closing ranges can be really tight. If that range is tight then any setup you enter the following morning is going to have a stop that’s really tight too. There will be plenty where that distance is prohibitively tight.

There will also be stocks where that range is really wide – too wide to make a profitable trade since the risk/reward ratio will not be suitable.

The Opening Gap and Immediate Trading Range

The second aspect that will likely be very important to the profitability of the system is the opening gap and the first few minutes of trading prior to the trade signal.

Recency is really important to think about when evaluating trading systems. What do I mean by that? In general, the more recent action is typically the most important. For example, which is more relevant to your system: yesterday’s opening range or today’s opening range? Of course today’s opening range because yesterday’s opening range is old news at this point. This is true for a lot of indicators too. Which is more important: the 50 day moving average or the 200 day moving average? A lot of traders look at both but if I have to choose I’m going to concentrate on the 50 day since it describes more recent action.

The most recent action prior to the signal will give you the most clues about profitability. The gap distance will be very important. The gap would definitely need to be modest. Defining what “modest” means for this system would be top priority. A large gap down followed by a breakout would mean price has covered a lot of distance in a short amount of time and I’d worry that the “move had been made” already. Notice even in this well chosen example the trade comes close to stopping out after just a few minutes:

Ponder the System’s “Theory”

A big mistake that a lot of traders make is they don’t think deeply about the trading system “theory”. When I first started backtesting I would often make this mistake. It’s tempting to simply follow what the data tells you. The data doesn’t lie, right?

What you realize with more experience is that while it’s true the data doesn’t outright lie, it frequently misleads. Fast forward to the point where you’re trading this system and an inevitable drawdown comes. You need to be able to believe thoroughly in the underlying theory of your system to trade through that drawdown. If you don’t you’ll likely give up.

My biggest worry now about this particular trading system is the closing range itself. What’s the theory behind why that range is so important? The system is really putting a lot of importance on it – after all the breakout and the stop is 100% defined by that closing range. I know from experience that price does a lot of aimless drifting during the last half hour of trading. You can always optimistically concoct a story about why that range is important enough to create a trading system around it. Right now I’m not convinced that there’s a compelling story. I would spend a lot of my research time pondering this question with a very skeptical stance.

Is it Tradeable?

I’m not sure but it seems worth looking into. Even if you don’t end up with a tradeable system, this type of research can be very valuable. You’ll pick up some tendencies and notice some behavior trends that you can use to apply to other systems.

What other factors would you look at with this system? Are there modifications you’d make to make it more profitable?

1 comment

Comments are closed.