When evaluating trading systems, how do you decide what frequency of trades is best? It seems like an easy question but there are several factors to consider and many of these decisions can be the difference between a successful trading system and one that’s not worth your time. Here’s my framework for determining the right number of trades for a model.

As Often As Possible? Maybe!

On one hand if your trading system has a significant edge then theoretically you should trade it as often as possible – no filtering at all, right? In practice though there is typically some filtering that needs to take place.

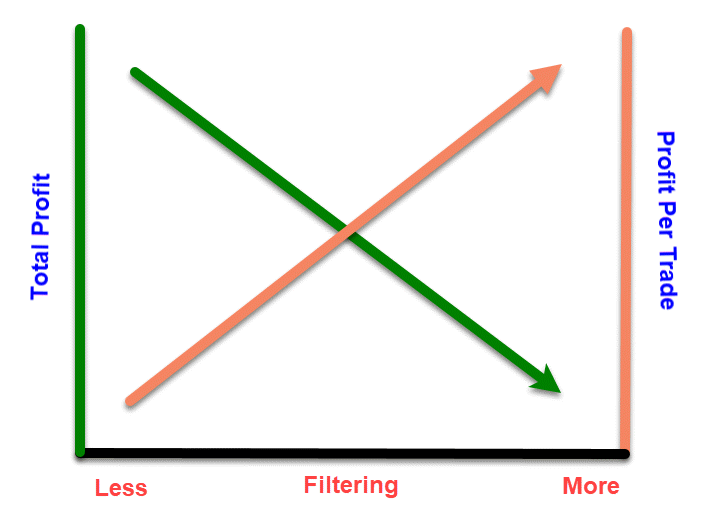

Consider the chart above. You have your trading idea, say, new highs on high relative volume. Most trading systems should start out with a basic trading edge – a strong theory that is supported by looking at a large number of trades in a backtest.

When done properly, the more filtering you do to your trading system the higher the profit per trade but the lower the total profit from the system. This is because proper filtering will filter out the worst trades at each point along the x-axis. (I estimate that 90% of my edge comes from my ability to choose filters that make sense – I’ll write about this soon.)

Imagine you can determine with decent accuracy which trades will be profitable and which will not. If you were really concerned about the win rate (unhealthily so!) then you could reduce the system to just a single trade that was highly likely to be profitable. But at what cost? Total profit of course. So you can see there’s a tension between total profit and profit per trade when you are able to meaningfully filter your trading system.

What’s the Right Balance Between Total Profit and Profit Per Trade?

This is the ultimate question and where most of your work occurs. There is an art to coming up with the right balance and a lot of what you choose will come from experience. Depending on your situation the more conservative approach would be to apply more filtering at first – that is, choose a point nearer to the right side of the chart. The more aggressive approach would be to choose a point nearer to the left side.

There are good arguments to be made for either direction. If you have more trading experience then the more aggressive approach can be quite valuable. The more quickly you gather live feedback from the market the more quickly you’ll be able to iterate and understand more about how your trading system acts in the actual market and how that differs from your theoretical backtest. Of course there are costs associated with this and as I’ve written before there’s always the real temptation to scale a trading system up too quickly (something I’ve done many times) since you’re typically overly optimistic at this point in the system development cycle.

If you choose a point towards the right of the chart you’ll have less risk but that comes with the cost of having to wait potentially a long time before the feedback comes (i.e. trade signals appear). Of course there is no “right” answer – you’ll have to gauge for yourself what makes sense given the nature of the strategy and your personal preferences.

Other Important Factors to Consider

How will this affect the systems you’re already trading?

If you already have a trading system that you’re trading how will these new trades affect it? Will the trade times overlap? Will this new system be a distraction? Is the trade frequency of the new system dramatically different than your current one? If so trading the new system might be a serious distraction from the trading you’re already doing. If you’re mentally burrowed down trading in the zone in one system and then a signal from another comes along you might underestimate just how much of a distraction that can be.

How fast is too fast?

Like the video clip from I Love Lucy above implies, there’s a point where you’ll be overwhelmed by the number of trades. There’s a wide variety of capacities among traders – some can easily handle more trades and others find it difficult. This can be alleviated by automating your entries, your exits, or both – something I highly recommend. Also note that you should err on the side of fewer strategies if given the choice. For example, would you prefer to take 10 trades from a single strategy or one trade from 10 different strategies? It should be obvious that 10 trades from a single strategy is preferable.

How slow is too slow?

Another factor to consider is what’s your threshold for the lowest frequency? I think about this in terms of trades per day. I try to keep my trading systems above 0.5 trades per day if possible. Why? I find that anything less than that and it’s not frequent enough to keep my attention. I need to be focused on the strategies I trade – understanding fully why they should be successful. There’s something about the repetition of trades in a system that keeps this focus in the forefront of your mind. As the frequency of trades drops it’s harder and harder to recall that focus quickly.

What about buying power?

A non-obvious factor when you add a trading system is the buying power that is required. The more trades in the system the more buying power needed. Combine this with systems you’re already trading and this could become a problem quicker than you realize.

It’s quite frustrating to run out of buying power just before some winning trade signals materialize! One thing I do is keep a log of buying power over time. This updates in real time as I’m trading. I can go back and see when I had the least amount of buying power available over a period of time and I can plan accordingly.

Which day had the most trades?

Trades per day is a good benchmark, but that number hides a very important piece of information – what was the day with the highest number of trades? This can vary dramatically between systems even with the same trades per day. It’s really important to plan ahead and visualize what those days would have felt like. Would you have been able to keep up with all the trades? Would you have run out of buying power?

It’s up to you!

It’s clear that once you take all these factors into consideration the choice for trade frequency for a trading strategy is a very personal one and there will not be a one size fits all answer for every trader.

Do you approach things differently? Let me know in the comments.

1 comment

Comments are closed.