One of the most common questions I get from traders is something along the lines of:

“Can you share one of your trading strategies with me?”

It’s so common that it’s easy to see why the trading industry is full of gurus who sell access to their specific trading strategy.

Buy here, sell here.

This model has never resonated with me.

Not because I’m “selfish” and want to hoard the strategies that I’ve created for myself.

It’s because to have any chance of success in trading for the long term you have to rely on your own intuition – not someone else’s.

You might have some success trading someone else’s stock picks, but I can assure you the quicker you are able to generate your own strategies from your own observations, the more long term success you’ll have.

And it will be way more fun and fulfilling for you than taking trades based on tips from some trading guru.

It’s my mission to have as many traders as possible create and improve their own strategies from their own ideas.

How do I do that?

One way is through a Trading Strategy Assessment, a service I’ll be publicly launching soon.

This is the exact same process I’ve used for over a decade to create and improve my own trading strategies.

Here’s a case study showing how it worked for one trader recently. Let’s call him Ted (not his real name).

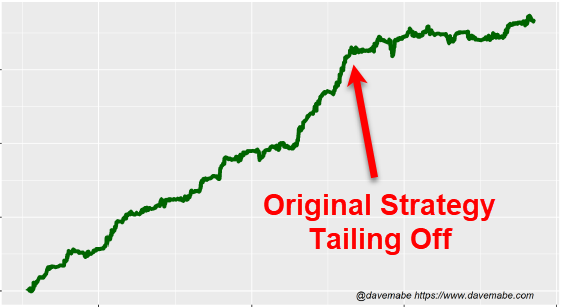

Ted approached me with a problem. His strategy had worked well for a long time but had started tailing off recently. See this chart of the equity curve and notice how the strategy was strongly profitable but recently the profits had dropped off:

This is a common situation if you’ve traded for any length of time. It’s frustrating!

I described how the Trading Strategy Assessment would work and Ted was on board.

At the end of the process, Ted gets a custom, 20-page PDF with full details about various ways to improve his strategy.

Here’s an example. We found that he was trading quite a few losing trades that could be avoided by adding a simple rule to his strategy.

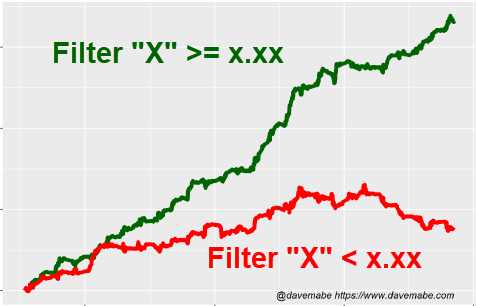

Here’s a chart of what it looks like in the assessment:

The red line represents the trades that would be filtered out with the rule. The green line is what the remaining trades in the strategy look like.

This represented a 52% increase in profit per trade for the overall system.

The assessment includes a variety of different rules to apply that Ted can pick and choose from, all without curve-fitting or over-optimization.

So instead of frustration, Ted now has a roadmap for several ways to improve his strategy, all of which are simple, quick changes to his strategy, not a huge overhaul to the way he’s trading.

The PDF also includes a long-term roadmap section. This outlines several ideas for tweaks that could improve his strategy significantly over time.

For example, areas of research for adding more profitable trades to the strategy or a change to the position sizing logic to generate more profits.

What I love about doing these assessments is that not only did Ted walk away with an immediately improved strategy (52% better profit/trade), but a roadmap for continuous improvement so Ted never has to rely on some Ferarri-driving trading guru again.

If you like trading rooms and following the crowd, that’s fine.

But if the idea of relying 100% on yourself for your trading success appeals to you, let’s talk.

I’m looking for a couple of people to help with the final beta testing of this assessment process.

If you’re interested, reply and let me know.

1 comment

Good stuff Dave! Your idea is solid.