Most traders and investors are familiar with the concept of earnings season: the period of time where most public companies release their earnings and various other fundamental financial metrics (price/earnings, cash flow, debt, etc) as required by the SEC. These company announcements very often trigger large moves in the stock price as the market responds and processes the the information about the company and establishes a new equilibrium. The volatility around this response is often quite strong and is the focus for many trading strategies. As I often say, I don’t attempt to trade the news but I trade the market’s reaction to the news.

Most traders think about earnings season in an inaccurate way. This post explains why that is and suggests a much better way to think about earnings seasons.

Why “season” makes no sense

The word season implies that there’s a definite start and end date. Consider deer hunting season. You have a definite start date where it is legal to shoot deer up until the end date of the season at which point it is illegal again. Everyone knows the well defined dates of the season and almost everyone adheres to these rules. This is not at all the case with earnings releases. You can literally find companies reporting earnings on every trading day of the year.

There is also general disagreement about when earnings season starts and ends. Traditionally it was thought that earnings season officially kicks off with the earnings release from one company: Alcoa (AA). Over the years as technology companies have become increasingly important this tradition seems to be fading somewhat.

I’ve noticed that traders often speak as if they are intimately familiar with earnings season but if you ask them to put the earnings season start and end dates on their calendar and you’ll end up with a variety of different dates chosen.

Does this make the entire concept of earnings season invalid? Of course not, but there is a much more useful way to think about the concept. Different trading strategies perform differently depending on how many companies are reporting. Some strategies depend entirely on earnings announcements and others AVOID earnings announcements specifically. It’s important to think about how your trading strategy is affected by earnings announcements and earnings season – for example, when you’re planning time away from the market you probably want to schedule the time outside of earnings season.

A better way to think about earnings

Here’s how I’ve come to think about earnings season over the course of over a decade of trading.

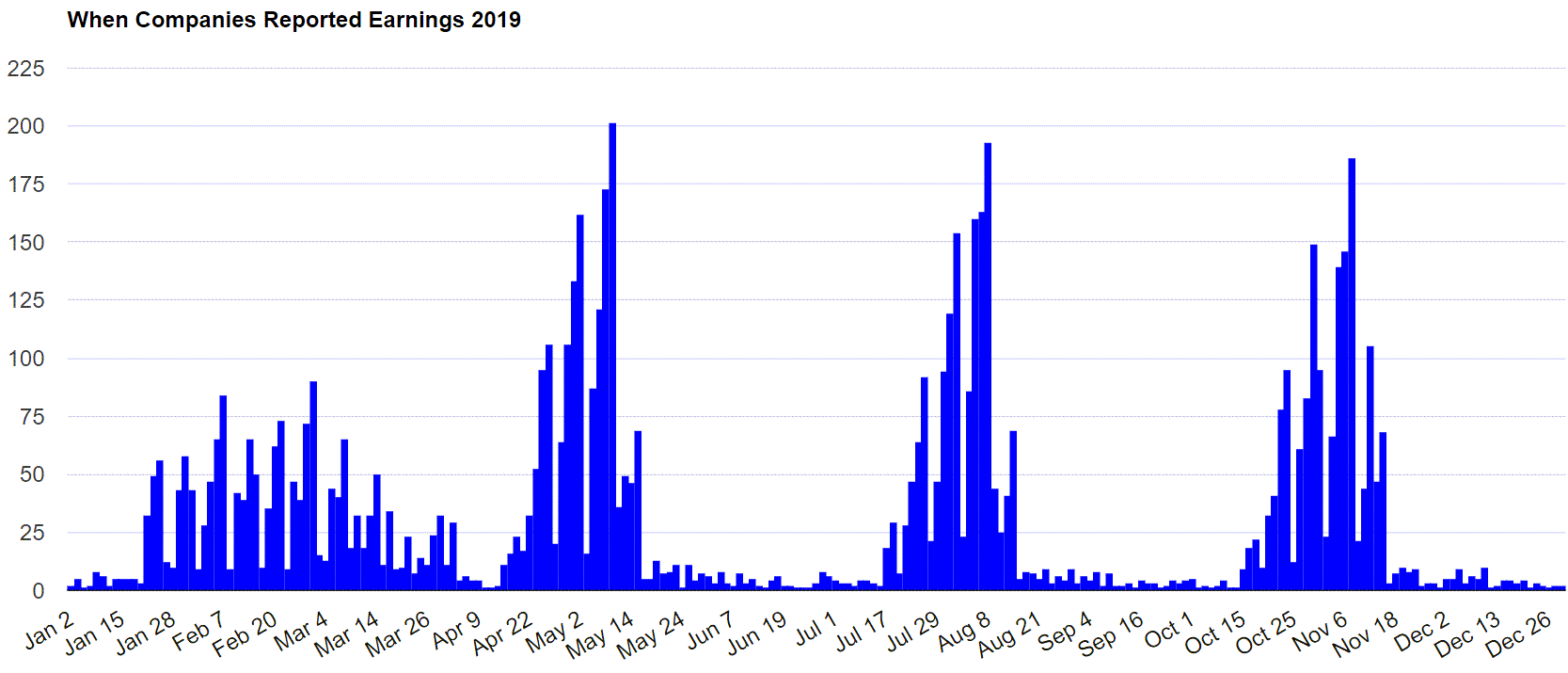

First, when you look at the distribution of when companies report earnings, you definitely see a clustering around certain times of the year. However you’ll also notice a lot of companies reporting outside those clusters. See the chart below.

The second thing that stands out from the chart: there are four earnings seasons throughout the year but the length of each of them varies widely. The first earnings season of the year is much more spread out than the rest of the earnings seasons. Why? Most companies’ fiscal years align with the calendar year so these companies are reporting earnings for an entire year starting in mid January. It takes longer to report annual earnings than quarterly earnings since you’re producing fancy, glossy reports and fulfilling additional requirements.

So what date makes sense to use as the start of a particular earnings season given the fact that companies report every trading day? Enough traders still respect the Alcoa earnings report as the start of the season to follow along. When you plot those dates on the chart it does seem to mostly align pretty well with what most would consider the start of the earnings seasons. Until some other method comes into vogue this seems logical.

What about the end date for each season? You can’t simply add a certain amount of days to each start date since the season length varies so much. A better way to think about it is for a given day calculate a percent of the way through that particular earnings season. In other words, of the total number of companies reporting that season, what percent have reported as of a particular date?

Dynamically Updating Chart Showing Earnings Big Picture

The above chart is dynamically generated and shows the current day (or next trading day) and what percent through the current earnings season we are. As of this writing it shows February 11th and that we’re 33.1% through the current earnings season. Use this chart to determine when it’s best to take time away from the market. Because the earnings seasons have different lengths, this visualization is a much better way to think about earnings.

Earnings Season is the Forest, now let’s look at the Trees

Now that we’ve used an intelligent way to determine where we are within earnings season, let’s look at the best way to scan for individual companies that have reported recently or in the near future. There are a few different tools you can use for this purpose but we’ll look at two: Yahoo! Finance Earnings Calendar and the Trade-Ideas Top List.

Yahoo! Finance Earnings Calendar

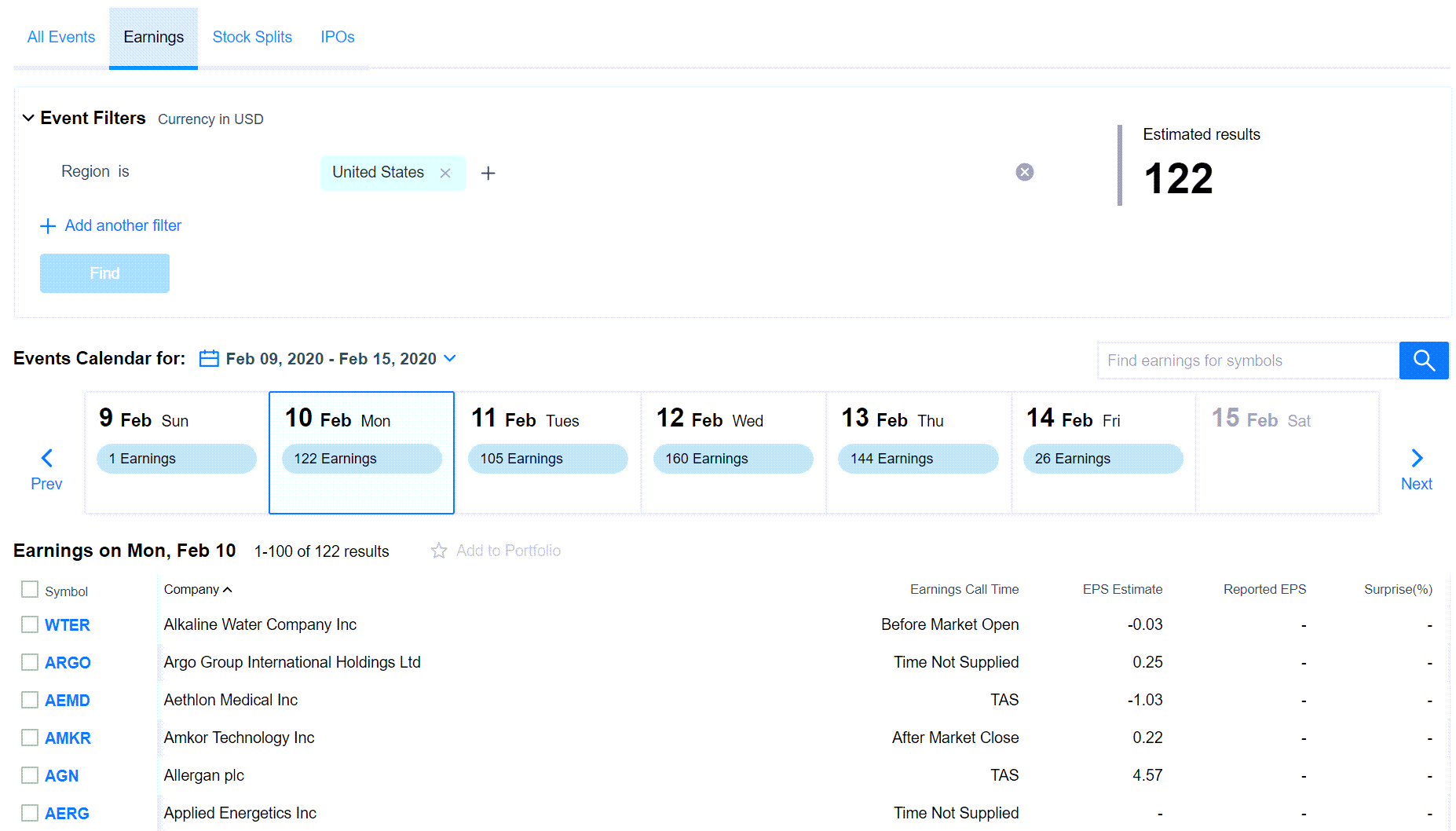

The Yahoo! Earnings Calendar is very popular and does a decent job of allowing you to see which companies are reporting on a given day. By default it shows all companies that are reporting today and you can click on adjacent dates in the header and see earnings announcements for these different days.

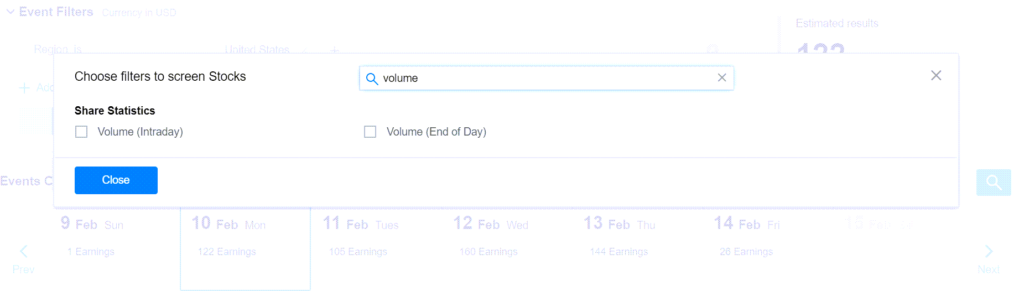

Because it shows all companies reporting earnings, the first thing you’re going to want to do is filter this list down. On the date I’ve chosen here you can see there are 122 companies displayed. That is going to be far too many to be able to process in a reasonable amount of time. Most of these companies don’t have enough volume to trade anyway. There are some filters you can apply to the list by clicking on the Event Filters link and at first glance the list seems substantial. However when you look closer and try to apply a simple filter for Average Volume you quickly realize that it doesn’t contain this very elementary filter.

This alone makes the list unusable but on top of that there are only a couple fields available to display for each stock. As a trader you need to be able to view the appropriate fields right alongside the symbol in the list. Looking them up for each symbol is time consuming and requires a ton of mouse clicks. This could be the difference between catching the trade and being simply too late to catch the move.

The other major drawback of this calendar is the fact that all companies that are scheduled to report earnings today are in the list. This includes companies that are reporting before the close as well as companies reporting after the market close. Why is important to make this distinction? Imagine you’re looking at the list in the middle of the trading day. A sizable number of companies in the list will have already reported prior to the market open but most of the rest will be reporting after the close.

These two categories of companies are dramatically different! Companies reporting prior to the open will likely be quite volatile while the ones reporting after the close will still have relatively calm price action prior to their earnings release. Similarly when you look at yesterday’s earnings reports the one that reported before the close have already had a full day of trading to process the report while the ones that reported after hours have not.

Most companies report their earnings after the close but a significant number report before the open. Here’s the breakdown:

Why is this important? It’s good to understand what the majority of companies do, but there’s another important difference. When companies report after the close there’s the post market trading session, the overnight, plus the pre market session before the next normal trading session occurs. There’s significantly more trading time plus clock time before the next trading day as compared to companies that report before the market open. I definitely have strategies where this dynamic has a strong effect. By the time the regular session rolls around, companies that reported yesterday after the close can be somewhat superseded by the companies that reported in the pre market.

Nasdaq has a similar earnings page but it suffers from the same limitations as the Yahoo! earnings page. These earnings views could be fine for a lot of investors but if you’re trading the markets you are definitely going to need more flexibility in your scan which ultimately saves time and effort and will allow you to take more profitable trades.

A Much Better Earnings Scanner: Trade-Ideas

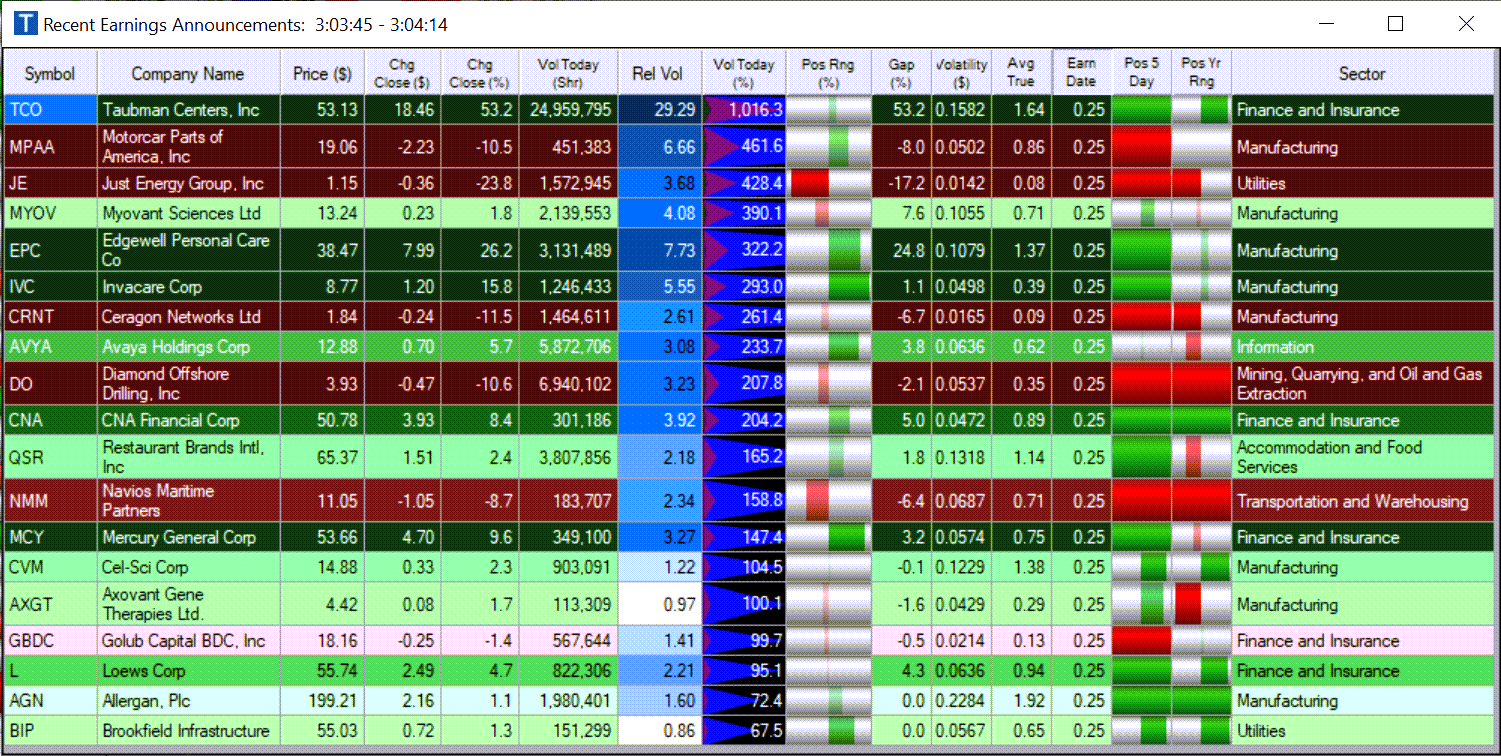

Trade-Ideas is a scanner and artificial intelligence product that is the best way I know of to display recent and upcoming earnings announcements. It doesn’t have the filtering limitations that the Yahoo calendar has and you can display whatever fields you want for each symbol. You can also quickly sort the list by any field and even paper trade any symbol using the Trade-Ideas simulated trading account that comes with every subscription.

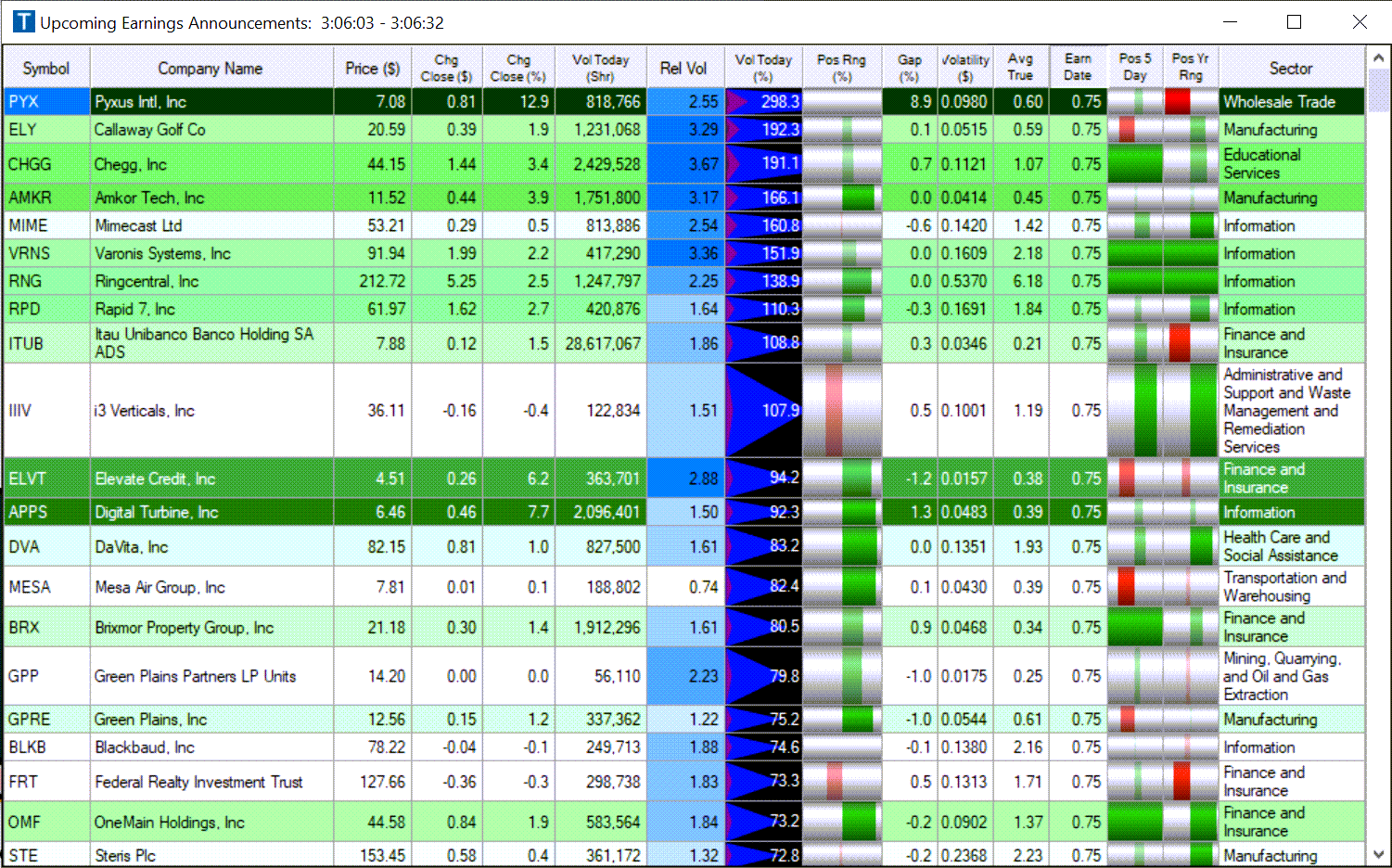

Here’s a view of my Recent Earnings Announcements top list window in Trade-Ideas. This list allows me to view only companies that have reported earnings this morning before the open OR yesterday after the close. That is, only companies where the current trading day is the first trading session after the company’s earnings announcement. I also have applied some basic filters to reduce the list of companies reporting earnings to just the ones that I’m likely to trade. For example, I have a minimum value for daily average volume and a minimum price of $1 and a maximum price of $500. I know that I won’t trade symbols outside of those thresholds so my list excludes them from the beginning.

This view is just not possible in other platforms. Here’s the cloud link for this window so you can bring up this exact top list in your Trade-Ideas.

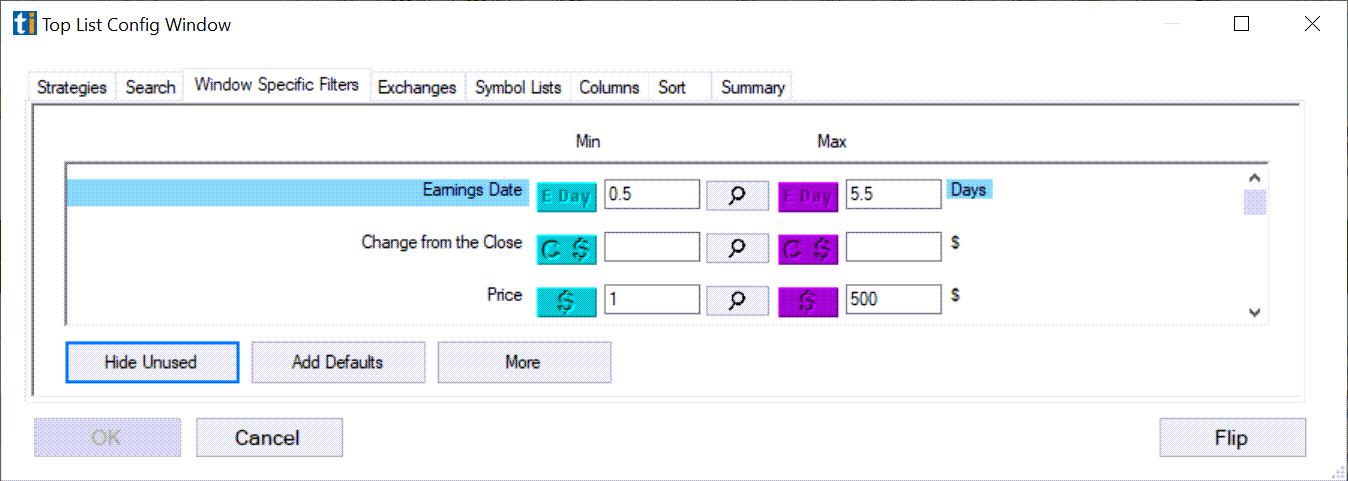

The second top list I frequently use in Trade-Ideas for earnings is my Upcoming Earnings Announcements window. I have it configured to show me all companies that are reporting earnings after the close today or at anytime over the following week. This view has all my favorite columns to sort by including the Earnings Date field. That allows me to quickly sort the list by when the company is releasing earnings relative to the current point in time.

So symbols will appear first on my Upcoming Earnings Announcements window and when the first trading session after their announcement comes around they’ll fall off that top list and appear on the Recent Earnings Announcements list that I use during the trading day. Here is the cloud link for my Upcoming Earnings Announcements window so you can bring up this exact top list in your Trade-Ideas .

You can easily modify the Earnings Date filter for your own use and, for example, only show companies reporting earnings before the next session or fewer days. To view only the companies reporting earnings in the next two days, change the value of 5.5 to 2.5:

These earnings scans are just one of many features that Trade-Ideas offers. Click on the link below to learn more about Trade-Ideas. Sign up and you can immediately start using the two windows I use to view Earnings Announcements that I mentioned above.

2 comments

Comments are closed.