Last year I made some big changes in how I trade my main 3 strategies. Each year I go back and review all the trades I took and see where I could improve. Are there any adjustments I can make to get better? Did any strategy perform poorly relative to what I expected? This is a good time to reflect on the changes I made and see how they played out.

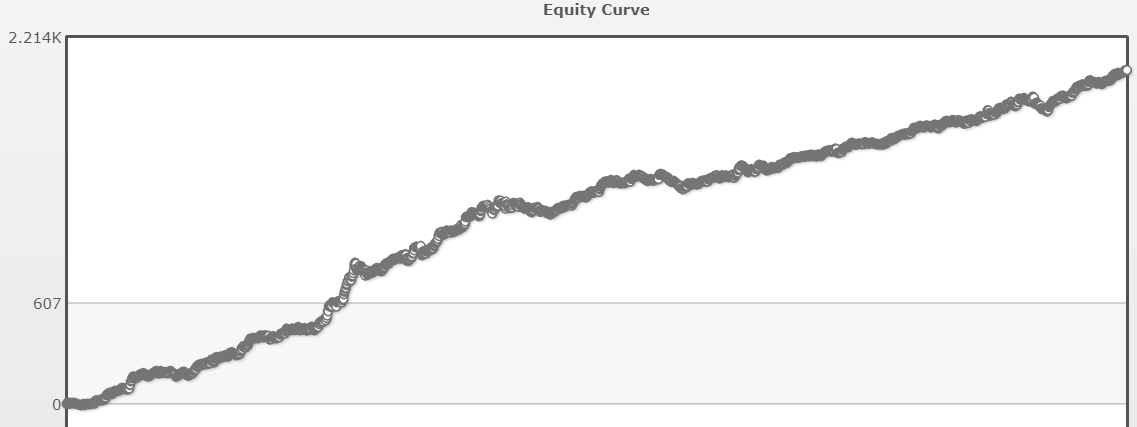

First of all, above you’ll find an equity curve (in R multiples) for the entire decade. The total R for the decade was 2011.9. This includes probably 10 strategies or so I’ve traded during that period. Pretty good. When you look at an equity curve zoomed out like this it looks smooth but when you zoom in you notice some drawdowns. One of the great benefits of using R multiples to measure performance is that it normalizes performance no matter the risk amount you’re using for a particular strategy. At any given point in time I may be at full risk in one strategy but a small fraction of that in another. Here’s a post where I go into detail about my process for sizing up.

My Gappers Strategy for 2019

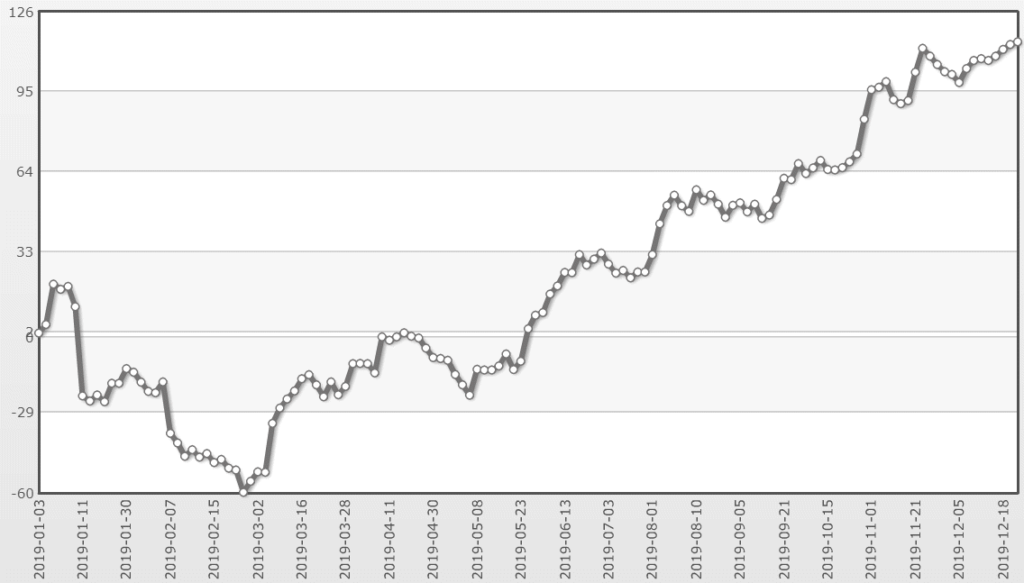

Although this curve looks ok by the end of the year, in March it looked terrible! That is the time where I took a step back and reevaluated what I was doing with this strategy. Keep in mind that the basic strategy is one that I’ve traded for over a decade now. I’ve made some pretty drastic changes to the strategy over the years but the fundamental strategy is exactly the same. So what did I do in March?

I started looking at my backtest in a completely different way. I removed the stops! (I know, I know – bear with me.) My workflow from the backtest went as follows:

- Create a backtest with very little filtering of trades – includes stops and targets.

- The Filter Phase: Apply filters to determine which trades from the backtest I’ll actually end up trading going forward.

The Filter Phase is the hardest part and the one that takes the most energy and experience to do well. The set of trades that I end up actually trading turns out to be a pretty small percentage of the total backtest. I realized that I was doing my filtering after the stop had been applied to the trade. This has the affect of ignoring some valuable information for each trade. Here’s my new workflow that I’m using now:

- Create a backtest with very little filtering of trades – NO STOPS OR TARGETS.

- The Filter Phase: Apply filters to determine which trades from the backtest I’ll actually end up trading going forward.

- Determine stops and targets to use.

Notice that the stops and targets are applied at the end instead of the very beginning. Why does this matter? The difference is subtle but turns out to be very important.

Let’s take two types of trades from the backtest. They both end up stopping out but the first type stops out but just barely and then continues in the desired direction. Here’s a theoretical example of the first type: LVGO from 1/14. It barely hit the stop price of 28.99 only to continue on.

The second type stops out and then continues its plunge finishing the day well below (assuming a long trade) the stop. A good example of this is STT from 1/17. It hit the stop of 83.32 and continued south for the remainder of the day.

In my original workflow, these two types of trades were considered equivalent and my filter phase would not notice any difference among them. In fact they are very, very different! My updated workflow accounts for this difference – I consider it like adding another full dimension to my backtesting routine.

I’m hoping to continue sizing up this strategy in 2020.

Strategy B

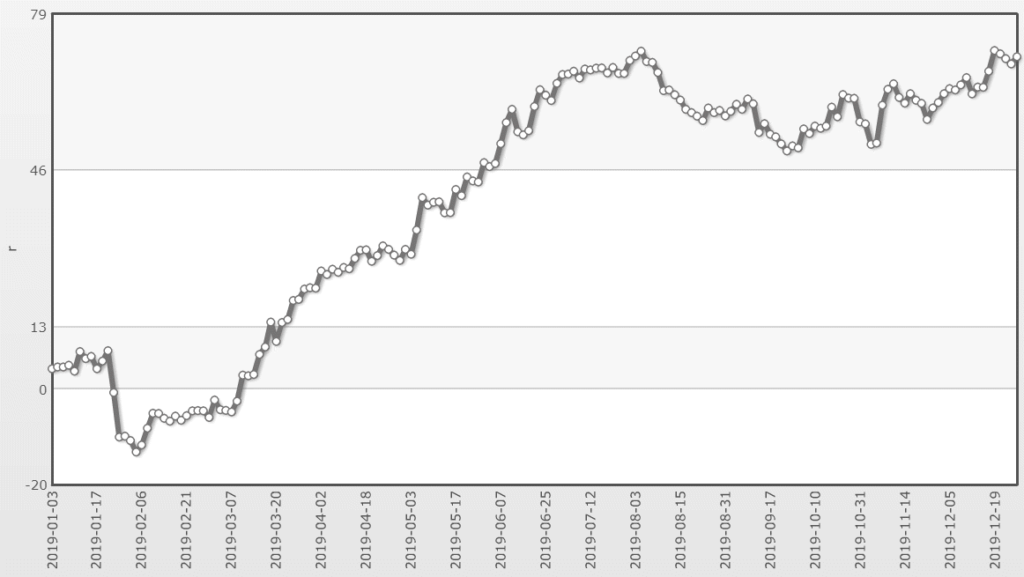

My other main strategy I’ve been trading largely unchanged since 2015 or so. Here’s the equity curve for 2019 for strategy B.

This doesn’t look great but when I zoom out and look at the chart from 2015 to present it looks fine having gained 400 R. This strategy is actually quite flexible. It’s designed to use variable position sizing based on the quality of the setup. I haven’t implemented that yet (I use same size for each trade in the strategy) but I hope to do this in 2020 which I’ll write about in a future post.

I hope you traded well in 2019 and you trade even better in 2020! If you have any questions feel free to contact me.

1 comment

Comments are closed.