I’m in the process of refreshing one of my trading strategies. It’s one that I’ve traded without making a single adjustment (aside from using a larger position size) for 8 years.

This is always my goal in designing strategies: optimize for longevity and staying power. If you have to re-optimize a strategy every few months, it’s really difficult to scale it because you can never achieve the level of confidence required to trade the strategy with a substantial position size.

This is my primary focus as make decisions when building a strategy. I don’t just want something that works, it needs to make money for a substantial length of time.

One of the ways I design for longevity is by analyzing stop levels for what works across a large number of trades.

Stops are really important in your trading strategy and most traders end up choosing them arbitrarily.

The distance to the stop determines the position size I use – that is, the farther away the stop is, the smaller the number of shares I use. This lets me risk a certain amount of money per trade.

This means, though, that the stop distance matters a lot! It has an enormous impact on how it feels to trade a strategy day to day.

I’ve created a great tool for myself to analyze stops. It’s very flexible and I can analyze stop distances in lots of different ways.

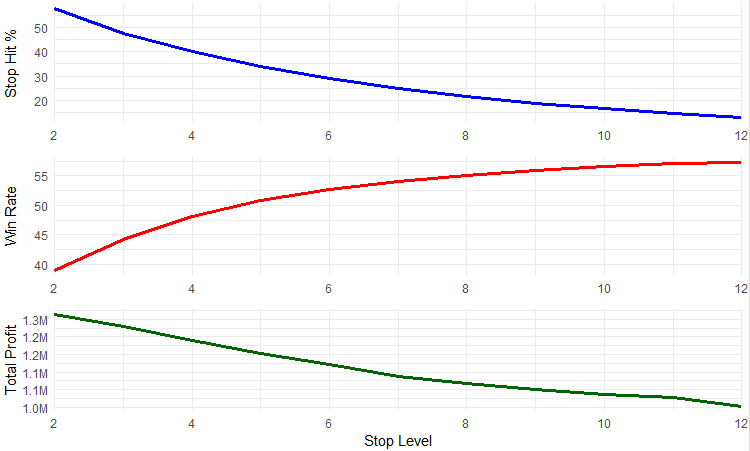

Here’s the output from the tool. I ran it in percent mode, and had it start at 2% and go through 12% (see the X-axis on each chart).

The three charts are lined up horizontally, so I can easily see how a certain stop level performs across these three dimensions: stop hit %, win rate, and total profit.

So why wouldn’t you just choose the level with the highest total profit?

Notice the huge variation in how often the stop is hit as the stop percentage increases. A strategy where the stop is hit almost 60% (with a tight 2% stop in the graph) of the time is going to be very difficult to trade psychologically.

Total profit is important, of course, but you need to look at the entire picture to create a strategy that you can actually trade.