We’re making excellent progress on Brokerage+ and I wanted to highlight a particular feature that I came up with several months ago. I’m calling it the “Profit Tracker” although I’m sure there’s a much better name someone can come up with for it. Here’s what I was hoping to accomplish with it.

The Humble Equity Curve

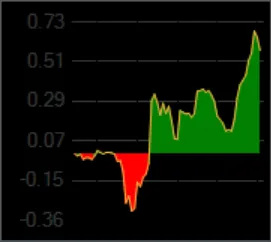

Every trader is familiar with an equity curve — basically a line or area chart of your profit (or loss) over some period of time. Here’s a screenshot of one that I just took from our Holly strategies window.

There’s a lot of information conveyed in an equity curve — this one shows the aggregate profit and loss from all positions throughout the day.

What the Equity Curve Lacks

Here are some questions that an equity curve DOES NOT answer:

- How many positions are contributing to the profit and loss?

- How many of those positions are currently profitable?

- What portion of the total profit is each position contributing?

- Is all the profit coming from a single out sized winner?

- How many of the positions are short versus long?

The equity curve is great because it’s easily understandable and it’s a simple and pleasing visualization (more pleasing when it’s more green no doubt!)

Trying to answer any of these questions makes the equity curve a lot more complex. You could add points to show when positions were initiated or make it a stacked area chart with each layer in the stack correspond to a position but by doing so you lose the simplicity and familiarity of the equity curve. I’m tempted to try a stacked area chart, but it would definitely have to be bigger to be able to zoom into the details — a simple equity curve can be very small and still convey the necessary information.

A Different Way to Visualize Profit and Loss

When I set out to try something different, I wanted to convey more information in less space by adding the ability to answer some of the questions that the equity curve does not. It should also be interesting to look at — for example looking at a chart is a lot more interesting than looking at a column of numbers in a spreadsheet.

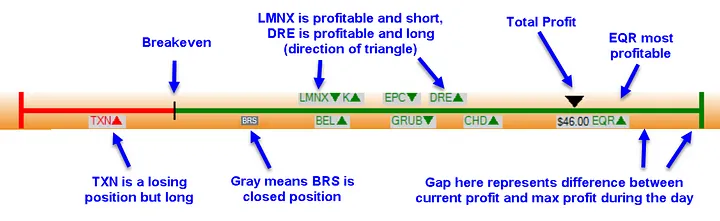

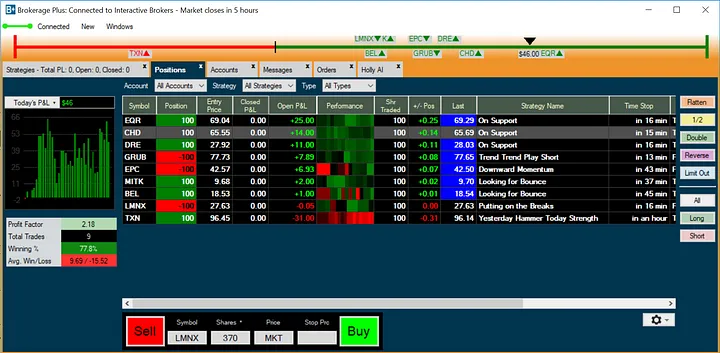

Enter the Profit Tracker. It’s a profit and loss continuum with each position plotted on it, but also the total profit marked with the larger black triangle. Here’s another image highlighting some of the details conveyed.

It updates automatically each second so the symbols jump around a bit with each update as it reflects the current status. You can see a live example of the Profit Tracker in Dan’s video from earlier today. Notice the Profit Tracker in the top left of the video.

Also note that there are some positions on the top of the continuum while others are on the bottom. Why? By default the Profit Tracker places them on the bottom, but if it realizes there are symbols that need to be placed close together it puts them on the top to minimize the overlap and try to make all symbols visible.

It’s Missing the Time Element from the Equity Curve — Or Is It?

By adding position data to the visualization, we essentially remove an important part of the equity curve — the time element. You can quickly see what the profit and loss was throughout the day in the equity curve where the Profit Tracker operates more like a current snapshot.

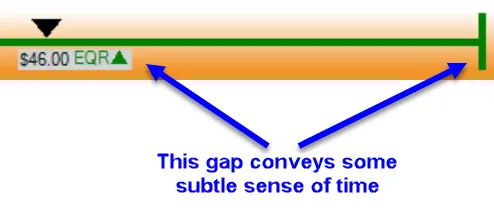

While there is no x-axis with time on the Profit Tracker, an indirect subtle indication of time is still there. The scale of the continuum is automatically adjusted based on the maximum and minimum points of total profit throughout the day. Here’s an example from earlier today zoomed into the right hand side:

With only a quick glance you can see that our current profit is off the highs for the day. While this doesn’t convey the exact time of day it does give us some sense that we’re off the highs and by how much. You can in some sense think of this as conveying the same information that the vertical axis does in an equity curve.

Where to Go From Here?

While I think this is a pretty useful and unique view of a portfolio, I think it can be improved.

- Use a gradient color for the symbol font based on some property such as profit level

- Vary the size of the font based on some aspect — recent profit movement for example

- Add a vertical mode that you decrease the overlap when displaying a lot of positions

- Display a tooltip with some information when you hovered over each position in the continuum

What do you think? Would you find it useful? Suggestions for improvement? Let me know in the comments and be sure and follow me on Twitter if you don’t already.

(Also, Brokerage+ is coming out of beta really soon, but there are a limited number of licenses available. Click here to see how to secure your reservation.)