- What is a Partial Profit or Scaling Out?

- What a Partial Profit Prevents

- The “Great” Compromise

- Partial Profits Cost You More Than You Think

- Psychological Comfort Has Value – But How Much?

- When Partial Profits Make Sense

- Reversals Will Still Happen

- How Frequently Should You Take Partial Profits?

- Discretionary Partial Profits

- Bottom Line

What is a Partial Profit or Scaling Out?

Taking a partial profit or scaling out of a trade is to exit some portion (but not all) of a profitable position. It is typically used as a sort of compromise: the trader wants to capture some profit but still wants to participate if the position becomes even more profitable in the future.

What a Partial Profit Prevents

You had a plan, you sized your position appropriately, you entered the trade at the right time, and your prediction was quickly realized by the trade heading in your direction. The inspirational sports movie theme music starts playing in your background. Ah the emotional satisfaction of being right! (Cue the music stopping abruptly.) Then the trade pulls back and you’re at breakeven. That’s ok – probably just a pullback. You have the will power to tolerate pullbacks like these. Then your stop gets hit and a nicely profitable trade turns into a loss. A very different theme music now plays in your background. You did everything right and still took a loss. If only you would have exited the trade while it was still in the green.

This is an especially difficult situation that all traders have experienced. Traders of all levels go through this routinely.

The “Great” Compromise

You’re in another profitable trade. You’ve done everything right and once again you find yourself with a tidy profit – but now you’re remembering the earlier trade that was in the exact same situation only to be stopped out for a loss. You know that exiting the trade now would be bad in long run, but you don’t want to suffer a similar loss when the trade has come this far. What do you do?

Early on in your trading career, someone made the very reasonable sounding suggestion that you should take half of your position off and let the remainder ride. Now you’re playing with “house money” as they say.

What an amazing compromise. The best of both worlds! Take a little here by taking a partial profit and let the rest ride. So sensible! Right?

Partial Profits Cost You More Than You Think

With any trading decision you make there are trade-offs. When you take a partial profit in a trade and it eventually hits your target you’ll have less size in the trade and therefore smaller profits relative to not taking a partial.

At what point do you take a partial profit? Is half of the position the right amount? Maybe you just do what feels right in the moment or maybe you have a solid plan to follow.

It’s easy to look at a single stock chart for a trade and imagine what strategy would make the most money, but it’s much harder to determine what works in aggregate across a lot of your trades. Any single trade is irrelevant – the big picture is far more important.

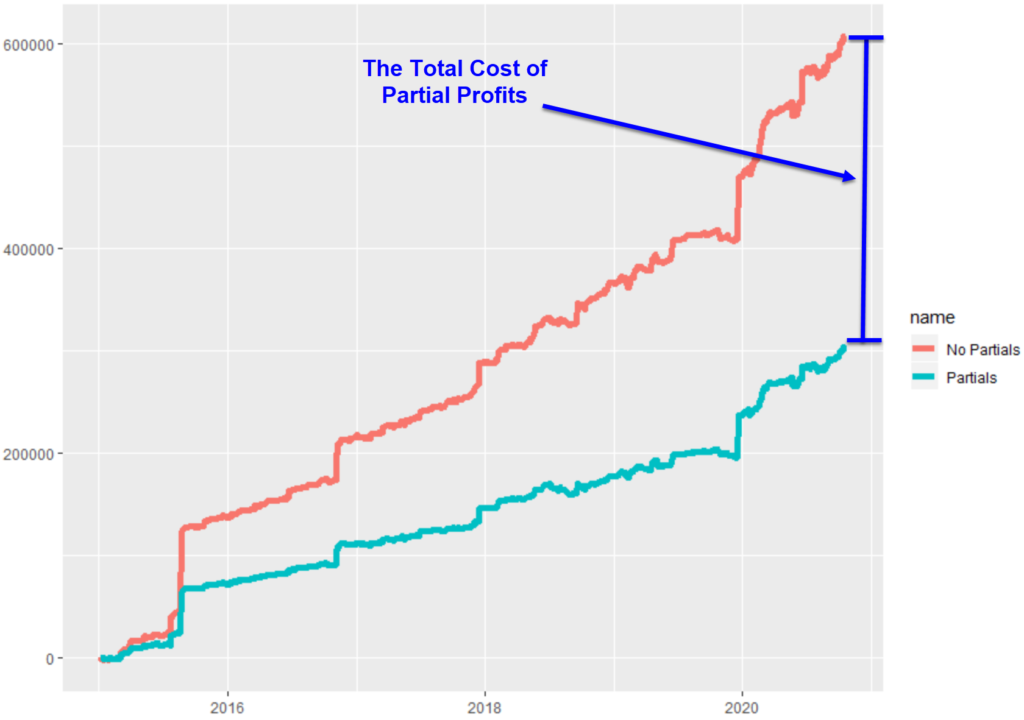

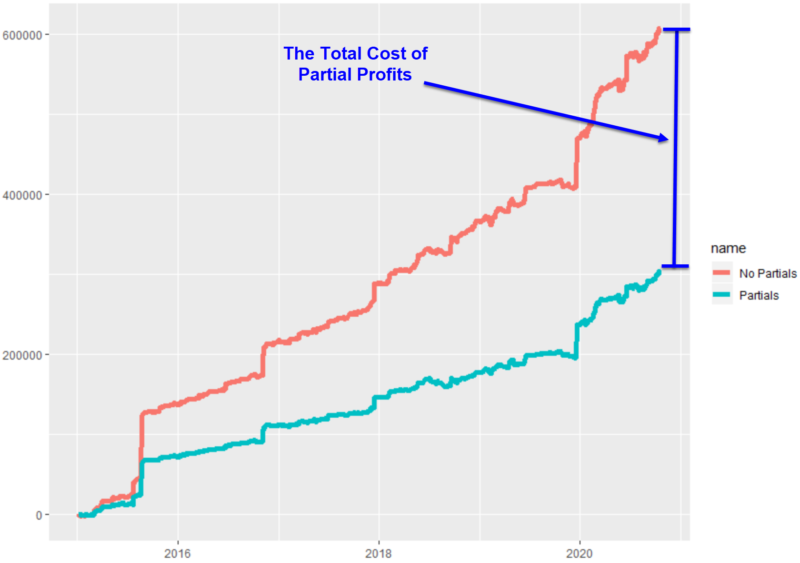

Here’s a backtest for one of the strategies I trade. I ran two backtests – one with no partial profits (the red line) and one with exiting 50% of the position when the trade reached a certain level of profit.

For this particular strategy taking a partial profit results in almost half of the total profit evaporating! This is a devastating chunk of your profits. All trading strategies are unique so they’ll be affected differently by including partial profits at different levels – but almost all of them will result in lower total profits. So does this alone put the nail in the coffin of a partial profit strategy? Not necessarily.

Those partial profits are buying you something of value: peace of mind. The psychological comfort of experiencing fewer of the difficult trading outcomes described earlier definitely has SOME value. How much do you value that peace of mind?

Psychological Comfort Has Value – But How Much?

Each trader is different and everyone has a different risk profile. Taking on risk is a personal decision – what makes sense for you might seem insanely reckless to another trader.

How should you think about the value of the emotional comfort of taking partial profits? Let’s look at the most common reason: you don’t want a profitable trade to turn into a loss.

As traders we love being right – sometimes even to the detriment of making money in the long run. There’s something valuable about making SOME money – literally anything above zero – even $0.01 – on a trade. This is somewhat irrational the more you think about it. The profit you make or lose on a trade is a continuous variable – that is, there’s a whole range of profit you could end up with. Of course, as traders, we’re trying to maximize this number.

When we reduce that continuous outcome to a binary – was there a profit or a loss on the trade – we lose the accuracy of that variable. You’re treating a $0.01 profit the same as a $1000 profit – both of these outcomes make the exact same contribution to “win rate.” Shouldn’t we treat the $1000 winning trade differently than the $0.01 winning trade? Your tendency to take frequent partial profits says you’re assigning the same value to a $0.01 trade versus a $1000 trade.

In fact, most strategies for taking partial profits are aiming for creating a worst case scenario of the trade ending up just barely profitable, precisely so the trade ultimately contributes (just barely!) to your being right win rate.

When you rely too much on partial profits, you’re optimizing on the wrong variable.

When Partial Profits Make Sense

Even when you realize that you’re optimizing for the wrong variable by taking partial profits, it still might make a lot of sense to take them. Here are some scenarios where it might make sense to value the comfort from partial profits more highly on the margins:

- You’re trading a strategy that has longer hold times – the longer the hold times the more likely you’ll be in a profitable trade that eventually pulls back

- You trade with size that’s large enough to substantially move the market, so exiting all at once is difficult

- You’re currently in a drawdown and you really prefer to avoid more losing trades even if they’re just barely profitable

- You trade at a proprietary trading firm and you settle up each month

Any of these situations would make you value peace of mind more highly.

Reversals Will Still Happen

It’s important to note that taking partial profits doesn’t allow you to completely avoid the situation where a profitable trade turns into a loss. Even when you’ve carefully chosen your partials strategy by looking at a large number of your trades, you’re guaranteed to still experience some of these.

With your partial profits strategy in place, you’ll still have profitable trades that almost reach the point where you’re taking partial profits only to reverse into a losing trade. It’s a situation that you can’t completely avoid.

How Frequently Should You Take Partial Profits?

Are you taking partials frequently or even every time a trade is profitable? If this is the case then it suggests to me that maybe your target is too far away. How would the aggregate numbers look if you moved your target closer?

If you can calibrate your target well you get the best of both worlds – trades that hit your target at full position size.

Discretionary Partial Profits

There are some very experienced traders out there that have an excellent intuitive sense of where to take partial profits in the heat of the moment. If you think you are one of these gifted traders there’s a way to verify this. Go back and look at trades that you’ve manually intervened in and compare those in the aggregate to your system. Was there improvement from your manual discretionary exits?

This takes some effort but it’s worth it. But beware: if you’re like me you’ll find that your shrewd trading discretion isn’t quite as shrewd as you think it is.

Bottom Line

A strategy to take partial profits is likely to cost you significantly more than you might think. The peace of mind you’re buying with them could very well be worth it, but it’s important that you analyze why you’re taking them and be honest about how valuable it is given the surprising cost in profits.

2 comments

Interesting. I think it would depend on your strategy and if you are a position trader or swing trader. A lot of the US investing champs advocate partial profits. Minervini and his followers seem to do this. Market conditions also dictate what would work better. In choppy market, partial profits and tight stops might smooth the equity curve. But good long trending markets, you need size to get those outsized gains.