This is the fourth in a series of articles summarizing the monthly trading strategy article in the Technical Analysis of Stocks and Commodities monthly magazine.

System Type: Equity Curve

Author of article: Oscar Cagigas, no Twitter but here’s his web site (Spanish): http://onda4.com

Deactivate/Activate you System Based on the Equity Curve

Oscar suggests a rule based way to toggle trading on and off based on the current equity curve of a trading system. He compares several different methods for doing this. The simplest is based on a moving average of the equity curve. If the equity curve falls below the moving average, simply ignore new trading signals until the equity curve rises back above the moving average. Sounds simple, right?

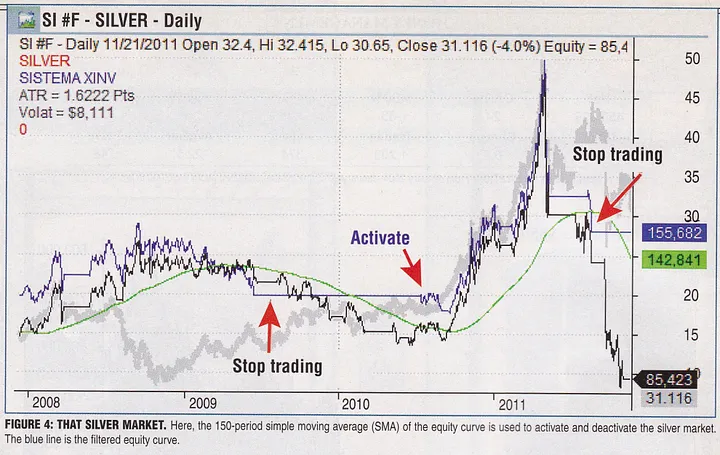

It’s more complicated than it seems. Of course, if you waited for your ACTUAL equity curve to rise when you’re not trading it you’ll be waiting forever. Because of this you have to keep track of the SIMULATED equity curve as if you didn’t pause your trading. This chart shows the process but it took me a few minutes to understand exactly what the lines meant.

I think the chart is overly complicated because it is overlayed on the Silver price chart which, although it’s the market for the system he’s trading, it’s secondary to our main purpose. The black line is the SIMULATED equity curve that we’re using as a reference. The blue line is the ACTUAL equity curve representing the subset of trades from the system that we actually take. By the end of 2011 you can see that the blue line ends up much higher than the black line.

He goes through 6 different methods to activate/deactivate your system based on certain aspects of the equity curve — the slope, different moving averages, a Donchian channel, etc. There’s a thoughtful discussion about this entire exercise just being an opportunity to overfit which he is careful to try to avoid. He also tests his methods using out of sample data which reduces the chance that he’s curve fitting. All the methods he tested showed varying degrees of improvement over the original reference equity curve.

My Take on Trading your Equity Curve

When I read this article my first thought was that making trading decisions based on your equity curve would overly complicate things. The underlying trades within your system don’t care what your equity curve looks like. If there was some correlation between the performance of trades and some aspect of the equity curve then you could pretty easily test it. If you detect any correlation my guess is it would be very small.

Keeping up with the reference equity curve, while not an impossible task, is definitely not a negligible chore. The process would be to run a backtest probably each night and chart it and see whether to activate or deactivate for the following day. Multiply this by the number of systems you have and it quickly becomes a lot of work and attention.

But Wait — We All “Trade Our Equity Curves” Whether We Realize it or Not

The more I thought about it the more I realized that we all “trade” our equity curves to some extent. If your account heads to zero you’ll be forced to reduce size since your buying power will be shrinking the whole way down and eventually, the deactivate switch will be set for you. Most of us would reduce position sizing long before that hard limit. That pain point is different for everyone and while a lot of traders would take action to avoid a big drawdown, I suspect many might not be able to articulate a well-thought-out plan ahead of time. Without a plan, we’re susceptible to fear and greed and our own human nature to make mistakes in the heat of the moment just like we are during the lifetime of each trade we make.

So is this “trading your equity curve” or a “well-designed money management plan”? A little of both.

My TODOs

Like my last post, I have a to-do item that’s tangentially related to the article. Put some thought into some better-defined rules for scaling down size during drawdowns. Periods of drawdown are inevitable and it’s well worth having a plan to react to them.