The other day I noticed that one of the symbols on my daily watchlist had halted in the middle of the day. It was TNXP on 12/7/18 and it was unavailable for trading from 10:20am until about 45 minutes later at 11:05am ET.

Years ago I worried a lot about halts. I had just read Fooled by Randomness by Nassim Taleb which had just recently been released and recommended to me by Trader Mike. (My Amazon account tells me I bought it in May 2006 which would have been less than a year after I started day trading.) That book has had a major impact on the world — the term “black swan” is now very common and people at least believe they understand the concept.

At that point in my trading career I was still a beginner. I had assumed all my life that day trading was risky and was still coming to grips with the fact that the vast majority of the risk was in holding overnight — which day trading specifically avoided. Being a risk averse person I still harbored the assumption that day trading was risky because everybody said it was. After reading Fooled by Randomness, I thought that trading halts were the black swans that I had ignored so I put a good bit of thought into them.

Research

Whenever I feel like I don’t understand something as well as I should, I do research on the topic until I’m comfortable with it. I wanted to at least get a sense of how big a problem trading halts might be. I downloaded all the trading halt history I could find on Nasdaq’s trading halt page and put them in a spreadsheet. The first thing I thought when looking at the data was that there are a lot more halts than you realize — there were 21 trading halts just on the one day that TNXP halted!

That seems scary but when you drill down you realize that most of them are thinly traded or just strange halts that aren’t likely to occur in most common trading situations.

What about the halts that do happen during common trading occurrences?

You Will Experience Them

If you trade for long enough, it is inevitable that you will experience a trading halt in one of your trades, and I assure you, it will be scary.

I’m pretty sure I’ve experienced 4 trading halts over the years, the longest of which went from Friday to the following Monday. That was not a very fun weekend!

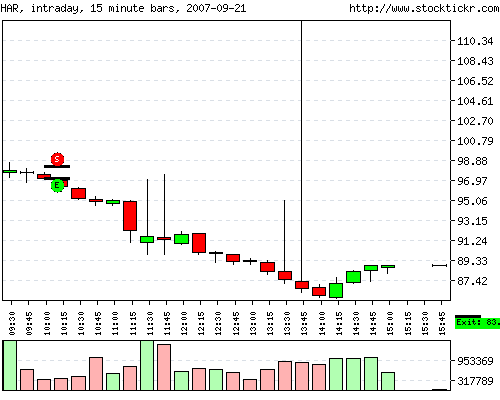

One thing to remember, though, is that once trading resumes after a halt sometimes price is in your favor. That is, some trading halts will hurt you but some will benefit you. As long as you have a healthy mix of long and short strategies, in the long run there’s a good chance that the halts you experience are going to be a wash. Here’s a chart of the first halt I experienced — HAR on 9/21/2007. This one ended up going in my favor for an over 8R win.

The Best Defense Against Trading Halts

Even though in the long run it should be a wash, you still need to do what you can to avoid being wiped out by a particular halt. The best way to minimize the damage is through proper position sizing. It boils down to a simple concept — do you need the money you have at risk? If it was tied up for a day, a week, or even many months — how much pain would that cause you? Make sure you size your positions such that you’re putting on healthy size but not so much that a halt would wreck you. This sizing is a personal choice without a “correct” answer, but it’s important to go through this thought process knowing that there’s a small chance that the money you risk on a trade could be tied up for A LOT longer than you imagine. Plan for the worst case scenario you can think of.

The other main defense against trading halts is, perhaps counter intuitively, trading a lot. The more statistically profitable trades you put on, the less impact a trading halt will have when you step back and take a long term view on your trading. Even a large loss from a trading halt should be just a blip on your long term equity curve.