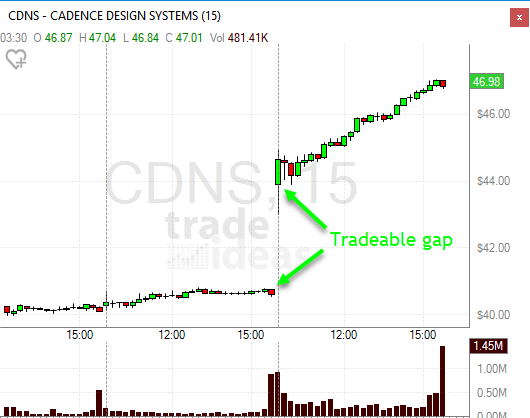

I’ve been trading gaps for over a decade. Over the years I’ve refined my trading routine using statistics and machine learning to figure out what works for me and what doesn’t, determining which gapping stocks I should trade and which ones I should ignore, how to best trade up gaps and down gaps, and automating as much of my trading process as possible.

Not all Gaps are Equal

Gaps up, gaps down, large gaps, small gaps, gaps with high volume, gaps with low volume — there are all sorts of different types of gapping stocks each day. How do you decide:

- Which gaps are tradeable?

- How to trade them?

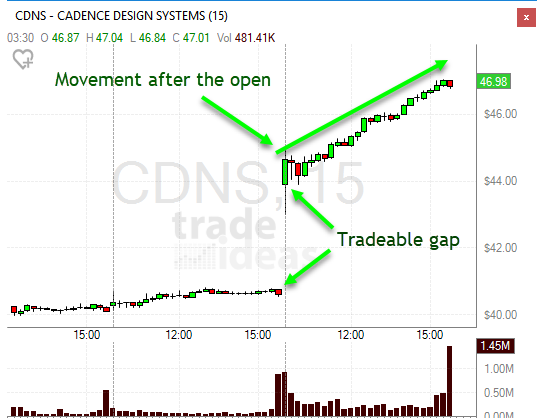

Of course these are not easy questions and it can take years of experience to get closer to the answers. What you’re primarily trading to answer is: will the stock have movement after the opening gap? If it is likely to move, then it’s tradeable.

My Daily Trading List

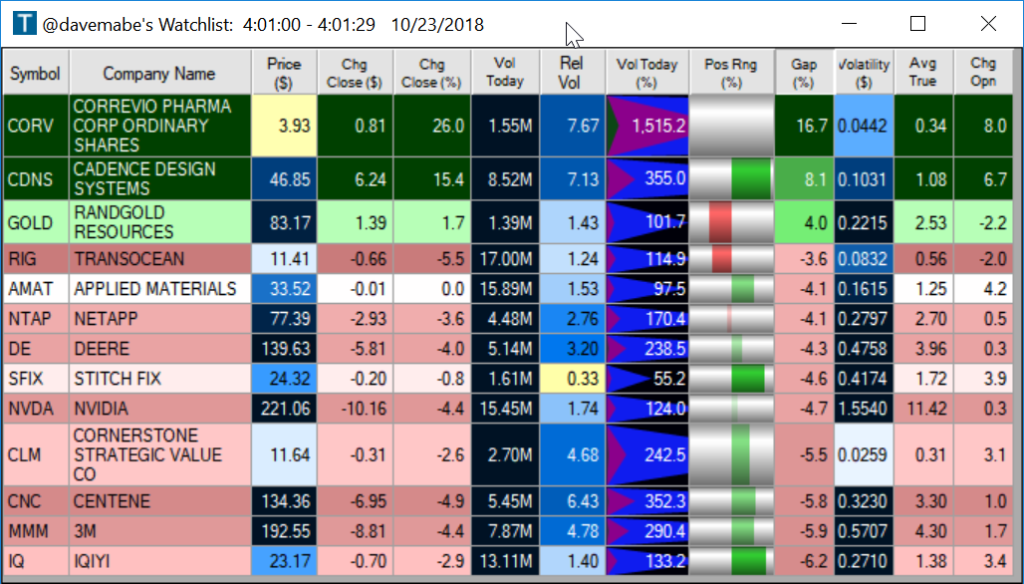

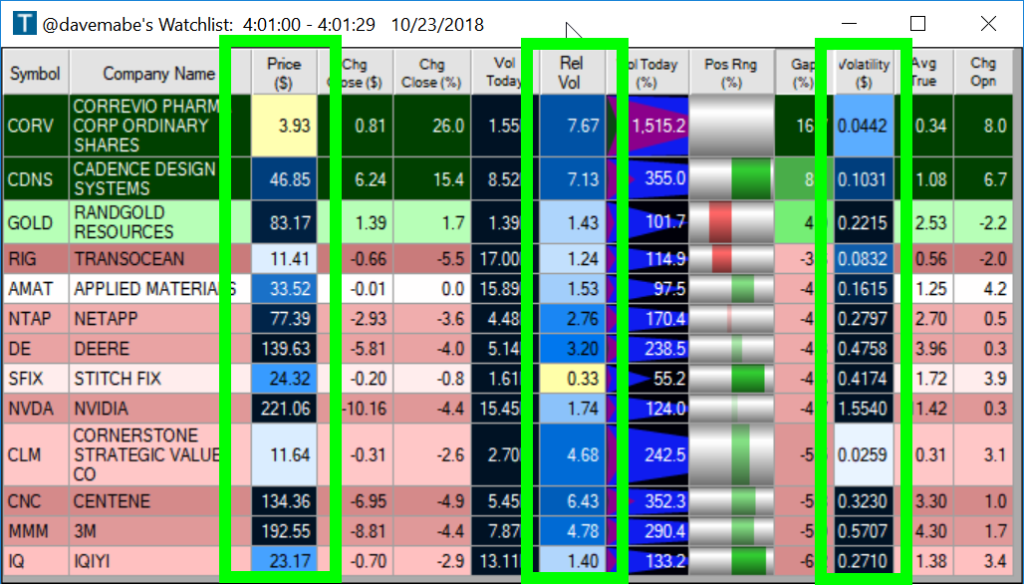

Each day I post my curated list of stocks that are on my gap trading radar for the day. This list mostly comes from my Trade-Ideas scan which I’ve honed over years of trading to efficiently generate a list of gaps which are worthy of possibly trading that day. My Trade-Ideas top list looks like this:

How I Use My Trade-Ideas Watchlist

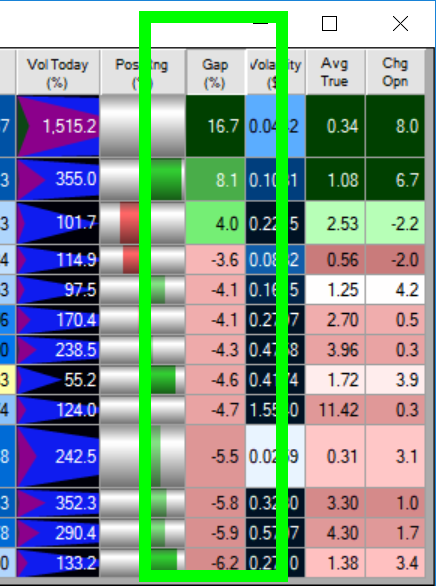

This one view of my watchlist in Trade-Ideas gives me a succinct view into the data points I need to make trading decisions. It’s sorted by the Gap% column so I can visually determine which stocks are gapping up or down and by how much. Green background means gapping up, reddish background means gapping down. The darker the green or red means the bigger the gap.

Other Important Columns Color Coded

Other data points that I’ve statistically determined are important for trading gaps are color coded. With just a quick glance I can see some stocks are more tradeable than others and some should be considered a priority gapper today.

Stocks that Will Likely Move After the Opening Gap

The list that I post each day has been curated by me to include only the stocks that have high likelihood to move after the opening gap. I don’t determine the direction for the purposes of this list, but potential for movement = tradeable.

Only once I determine that the stock has a good chance of movement after the open will it make my daily tweet:

How do I Trade These Gaps?

I use 4 different strategies to trade these gaps: 2 long and 2 short. Over the years I’ve made the actual order execution as quick and painless as possible. When I started trading over a decade ago, I entered the trades manually. I quickly realized that there were two main ways this was hurting me:

- Time consuming which caused me to miss profitable gap trades

- Occasional order entry mistakes (position sizing, stop placement, etc)

I eliminated both of these problems using software. I started developing my own software to enter the trades. A combination of man and machine helped me take more profitable trades and eliminate all my order entry mistakes. I quickly learned that entering trades this way opened up lots of new opportunities to trade profitably.

I’ve gone through several iterations of the trading software over the years: fine-tuning certain aspects and adding new features that over time I discovered that I needed. That process has culminated in Trade-Ideas Brokerage+ which I developed.

Give Brokerage+ a Look

If you know anything about developing software, you know it’s harder than it looks. I’m proud of what my lowly first attempt at order entry software a decade ago has morphed into.

I invite you to look and see what Brokerage+ is all about. Kick the tires and let me know what you think — I’d love to hear your feedback!

7 comments

great intro to gap-trading! thx for helping to get started with this concept. it’s a highly risky chance-play nontheless, is it not?!? or what percentage of success did you reach after your years of learning-how?

@oliver – of all the strategies I trade it’s the one with the lowest win rate, but still profitable. ~40% win rate. The key is determining under which circumstances to take the trade and which to ignore.

Thanks for the comment.