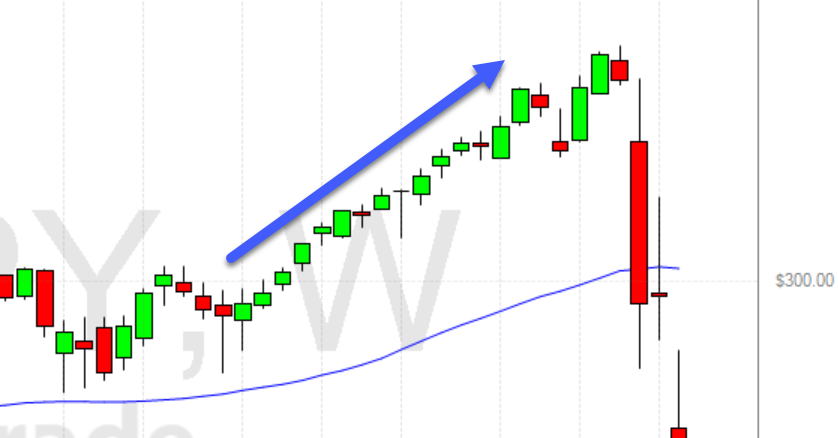

The volatility we’re currently seeing in this market is enormous and marks a huge change from what feels like a very short time ago. Just look at this chart of SPY and it’s easy to see how things have so dramatically changed.

I’ve done tons of research into understanding how my trading systems work and knowing what factors affect them. When the market has changed so dramatically though, how valid can all that research really be? How much weight do you place on the recent market action versus the market history up to that point? Of course the market has changed – does that mean my trading systems have changed too? By how much?

These are somewhat philosophical questions that every trader will handle differently. Some trading systems are highly sensitive to the overall market while others are more resistant to it. Here are some things I do after hours or on the weekends to prepare answer some of these questions.

1. Update your Backtests with Recent Data

Remember back when March Madness still existed? Imagine filling out your bracket and trying to make the best predictions you can while only looking at the first half of the season. The most recent games are OF COURSE the most important! Ignoring them would be insane. That is what it’s like when you make trading decisions based on older data.

Now is the time to update your backtests so they contain the most up to date information including recent trades and various data points from the overall market that you think might be important to your systems. I spent the weekend updating all the backtests for the systems that I trade. This gives me as complete a picture as I can reasonably create.

2. Compare Performance to Similar Historical Markets

This is something I do routinely, but the change has been SO drastic that it’s hard to find ANY similar historical market. If you look hard enough, though, you realize that literally every trading day is different. Look at the candles identified by the blue arrow in the chart below. Generally speaking the candles are similar – pretty small and mostly green. Even during this period of what seems like consistency you’ll find lots of variation from one day to the next and one week to the next. This should worry you during “normal” times but during times like this with high volatility it makes me worry a little less.

Here’s what I do to compare to similar markets of the past even when no similar ones REALLY have occurred.

Data Points that Describe the Current Market

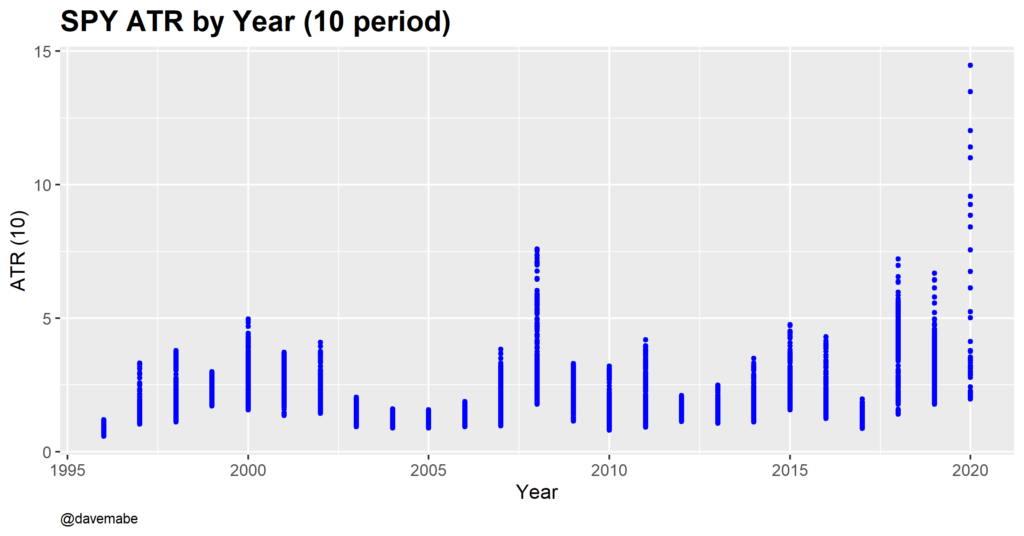

It’s tempting to look at a data point like Average True Range (ATR) – a popular indicator to determine volatility. Here’s a ten period ATR for SPY with the values for each day plotted according to the year it occurred. You come away with the impression that this market is roughly twice as volatile as even the 2008 market. No other market can even compare – yikes!

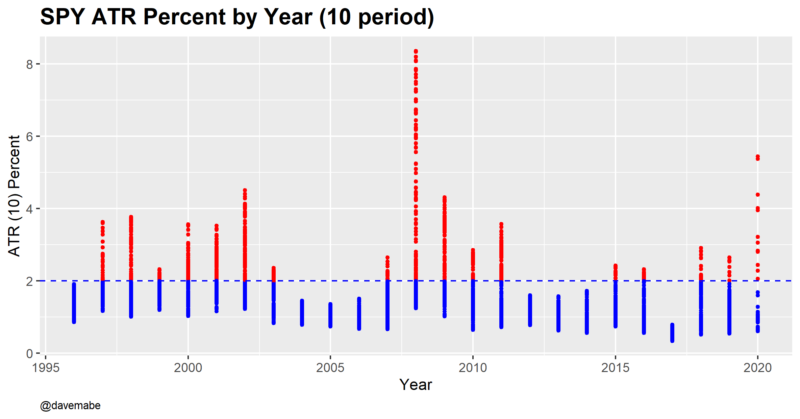

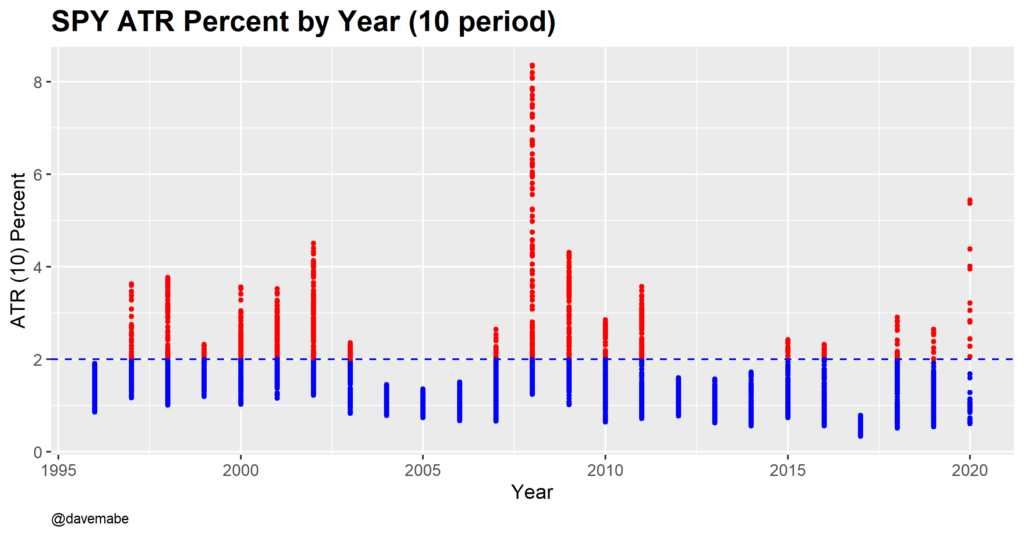

The true picture is more complicated though. The SPY, of course, is much higher now than it was in 2008 so a 2 point swing in the market in 2020 is nothing but in 2005 there were hardly any days with that much range. When you look by ATR as a percent the data looks much different:

The market from 2008 and 2020 have now flipped! 2008 looks way more dramatic than the current market. You’ll also notice that although there weren’t as many volatile days since 2008, there are still some useful periods in recent years to compare to.

I’ve spent a good bit of time looking at my trades during the periods in 2015, 2016, 2018, and 2019 where the SPY ATR percent was greater than 2. Some of my trading systems did well during these periods, others poorly, and for others the performance was about average. Going through this process gives me a much better perspective on the current market. I can make decisions with more confidence. For example, I know which of my trading systems I should be trading with bigger size now and which I trade smaller or not at all.

In addition to ATR percent, I’d suggest taking a look at the market’s position in its recent range and look for times where ATR percent was relatively high AND the market is very low in its recent range.

3. Do as Much Prep as you can After Hours

When you’re looking for unusual situations to trade – like stocks gapping up or down – what do you do when EVERYTHING is gapping up? These recent days have put me in exactly this situation and it’s something I thought I was prepared for. Last Wednesday I tweeted this:

Tomorrow there are going to be even MORE candidates for one of my trading systems. How am I preparing for this so I’m not overwhelmed like the other day? After all, if there are a lot of candidates on some days for your system, those are the days with a chance of being very, very profitable. Plan for them since they don’t come very often!

Here’s what I do. I know that there are certain factors that correlate highly with the profit of my systems. Relative volume is a good example for one of my systems but for others that value is not as important.

Normally I’ll take all the trades that my system spits out, but on the rare days where there are more trades that I’ll be able to take I’ll only take trades that rank highly on the most important factors for that particular system. For each of my strategies I have an alert window in Trade-Ideas. Those are alert windows for “normal” days. I also have prepared alternate windows for each of the strategies for “busy” days. These busy day windows have more restrictive filters, so if I have to choose between trades I can quickly execute my pre-planned strategy for making that decision rather than having to make a decision I’m not prepared for.

In addition, I already know that tomorrow there will be a VERY LARGE number of candidates in one system. Normally I look at the premarket action to determine what to trade which on regular days I have plenty of time to do. There will not be nearly the amount of time necessary to do that when there’s 12 times the number of candidate though!

There are some factors I can look at NOW (on the weekend) to plan ahead though. What I normally do just before the market open I’ll do this weekend – whittling the list down to a manageable number of candidates before the time comes. This is a really valuable exercise not only because I won’t have to skip trading like I did on Wednesday. It also forces me to learn more about this particular trading system. For example, perhaps there are some trades in the system that I should exclude entirely even on “normal” days. Or conversely, maybe there are trades I should be trading with bigger size. Maybe I’ll find some trades that don’t quite meet the system’s criteria but with a small adjustment I could include them, adding more profit to the system overall.