In Annie Duke’s book Quit, she describes a study of the behavior of 2000 cab drivers in New York City.

The authors of the study analyzed the data and realized that drivers could make significantly more money by working longer on the good days when the fares were plenty and driving fewer hours on the bad days when demand was low. Why were the majority of drivers not recognizing this shortfall?

They interviewed several of the drivers and realized the problem…

It’s human nature to set benchmarks and track them, and most cab drivers do just that. They have a revenue amount in mind that they’re trying to achieve each day. When they hit the number, no matter what time it is, they quit for the day and go home.

As you might imagine, on some really good days they hit their number very early in the night. On other days when there’s less demand, they might drive long hours and still not make their personal daily goal.

The study found that cab drivers could increase their earnings by 15% by working the same hours but, instead, allocating them based on demand – working longer hours on the good days and fewer on the bad ones. Their daily goal-setting, which feels productive, actually causes reduced earnings.

Daily Trading Goals are Counterproductive, Too

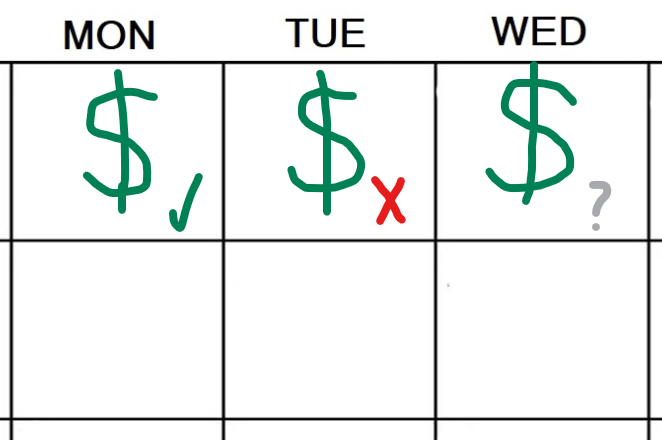

If you’re similarly setting a daily profit goal for your trading, you should rethink that immediately. Opportunities in the stock market don’t come at a constant rate – some days will be flush with more great trades than you can take while other days the market will feel like a ghost town.

You have no control over the rate of these opportunities – there’s no way you can create them, all you can do is be ready when they arrive. That means having the discipline to sit on your hands and not force any trades when they don’t exist. If you don’t trade with a system, you’ll always be able to squint hard enough and find a trade to take.

If you look at a successful trader’s results, one thing immediately sticks out: almost all the profit comes from a small percentage of trading days. I just checked my journal for the best-performing of my 15+ trading systems. Of the 101 trading days so far in 2023, there are just 60 days where it took at least one trade, 41 of those trading days ended up with a profit, and 19 of them ended up with a loss. Of the 41 profitable trading days, a lot of them had a marginal profit. All the heavy lifting that makes this strategy profitable happens on less than 10% of days. If I had imposed a daily trading goal on those days, this strongly profitable strategy would be the opposite: a loser.

Trading success involves tremendous discipline and sitting on your hands when conditions aren’t favorable.

Daily trading profit goals cause you to take the exact opposite approach from what’s required for success.

Shooting for a Certain Number of Trades is Just as Bad

There’s a related line of reasoning I’ve heard from traders that sounds accurate on the surface. They don’t have a daily profit goal per se, but they have a goal of a certain number of trades to take. They correctly recognize that although it’s bad to overtrade by taking some subpar trades, it’s much worse to undertrade and miss out on big winners. That fear of missing big winning trades causes them to take marginal trades on slower days in hopes of capturing as many big trades as possible.

This is wrong for the same reason that a daily profit limit is – there’s not a quota for trading opportunities. The profitable situations for your strategy are independent and not related to each other. A daily “number of trades” goal treats them as if they are.

A Daily Trading Goal That Works

Define your trading rules and stick to them.

Then your daily trading goal becomes really easy: follow your rules.

4 comments

Agreed! Your article highlights the contrarian nature of professional trading. The vast majority of humans are programmed through family, social structure, education and professional environments to set very specific goals which, when achieved, signal an opportunity to consider the job done. This “works” because the vast majority of situations in life don’t depend on the math of probabilistic outcomes. The remuneration component for most people is static. Trading, as you point out, is exactly the opposite. Successful traders are finely attuned to how their decision-making processes affect the underlying math of their business. This is precisely why it is so destructive financially to move stops and exit trades early.

@DMactrades – that’s a great point about how humans are programmed. I think people just like steady income and trading is certainly not that! It’s really hard to get accustomed to that and most people just don’t have the stomach for it.

Three interesting books on programming / mindset are:

1. The Four Agreements by Don Miguel Ruiz (a quick read that is primarily focused on a moral code of conduct, but introduces the idea of how we are programmed from an early age)

2. Mindset by Carol Dweck

3. Annie Duke’s other book, Thinking in Bets” is a good one as well.

@DMactrades – thanks for posting these books. I’ve read Thinking in Bets, which I agree is excellent. Have not read the first two, however. I’ll add them to my list – thanks!

Comments are closed.